Hello all,

What have we accomplished in the last month? New Quantpedia Pro reports, new Position Sizing course and as usually – a lot of new Quantpedia Premium strategies, papers and backtests.

So, let’s first quickly recapitulate Quantpedia Premium development: 10 new Quantpedia Premium strategies have been added to our database, and 10 new related research papers have been included in existing Premium strategies during the last month. Additionally, we have produced 11 new backtests written in QuantConnect code. Our database currently contains over 450 strategies with out-of-sample backtests/codes.

And now, let’s move to our Quantpedia Pro subscription offering news.

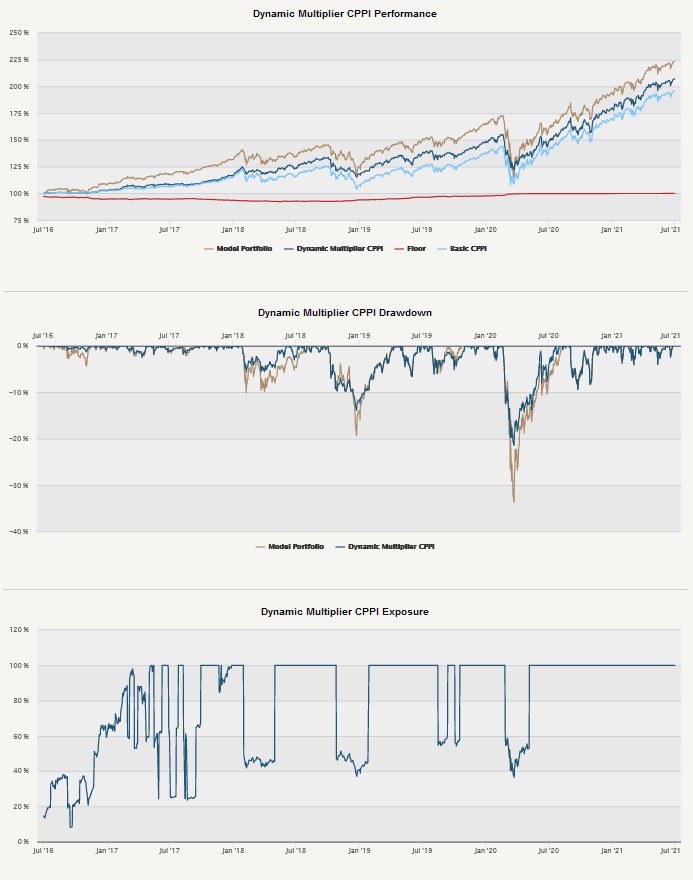

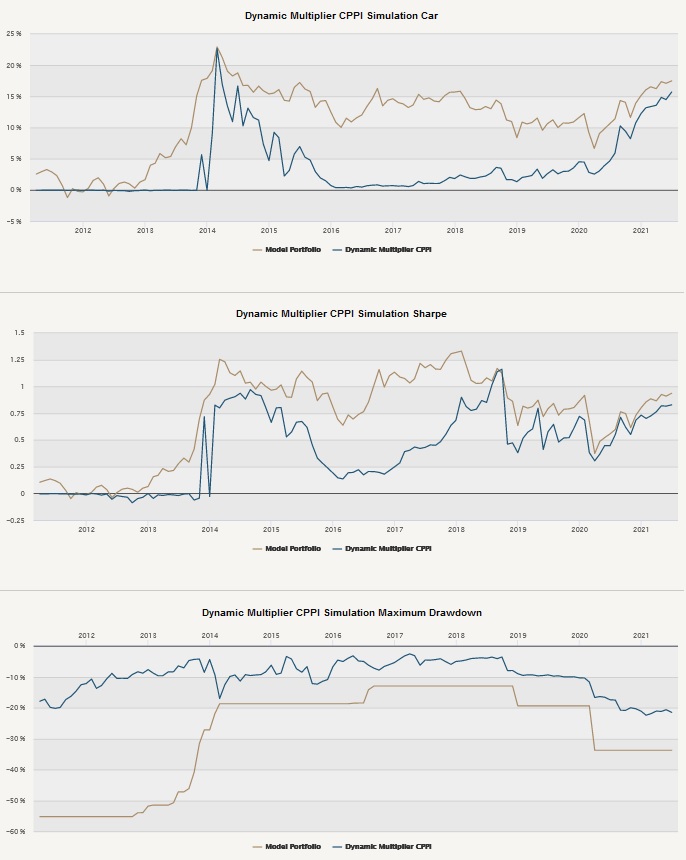

We spent June preparing a series of three new CPPI reports (Constant Proportion Portfolio Insurance). CPPI is a strategy that allows an investor to keep exposure to a risky asset’s upside potential while providing a guarantee against the downside risk by dynamically scaling the exposure. Quantpedia Pro clients can use the model portfolio built in the Portfolio Manager as a risky asset to test various variants – Basic CPPI, Drawdown Based CPPI and Dynamic Multiplier CPPI. Each CPPI report conducts two types of analysis, and in both cases, we decided to analyze 5-year periods.

The first one is a single period analysis. We first analyze the CPPI performance and floor evolution in the single-period analysis during one specific five-year period (the last five years). We present a table that compares the risk characteristic of the pure model portfolio and the CPPI portfolio. Then we show equity curves of the model portfolio, CPPI portfolio and the floor. Afterwards, we present drawdowns of CPPI and model portfolios and a chart that shows CPPI exposure to the model portfolio.

The second analysis presents the simulations of multiple 5-year periods, each starting one month after the previous one. We then compare the results of the distribution we obtain of the CPPI vs model portfolio and show distribution charts of the 5-year annualized cumulative returns, Sharpe Ratios and maximum drawdowns, as well as tables that compare distributions of risk characteristics of CPPI and model portfolios. As usual, we will publish a short article about all of the math & methods behind these reports in a few days.

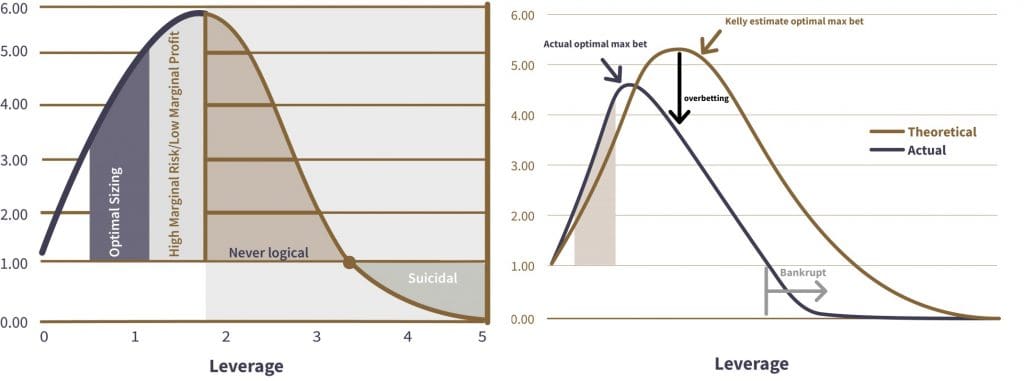

Additionally, in cooperation with QuantInsti, we have launched a new practically oriented course called Position Sizing in Trading, which aims to explain the money management techniques to intermediate level traders. The course presents an Index Reversal trading strategy written in python and applies to it different position sizing methods like Kelly Criterion, Optimal F, CPPI (Constant Proportion Portfolio Insurance), TIPP (Time-Invariant Protected Portfolio) and Volatility Targeting. Additionally, the course shows how to deal with performance deterioration, non-stationarity and fat-tails in the financial markets so that you have a complete conservative framework for position sizing. You are sincerely invited to visit the course’s introductory page (plus, you may apply for a 65% discount during the launching period until the 11th of July) …

And finally, four new blog posts that you may find interesting have been published on our Quantpedia blog in the previous month:

Community Alpha of QuantConnect – Part 1: Following numerous quantitative strategies

Author: Matus Padysak

Title: Community Alpha of QuantConnect – Part 1: Following numerous quantitative strategies

The Knowledge Graphs for Macroeconomic Analysis with Alternative Big Data

Authors: Yucheng Yang, Yue Pang, Guanhua Huang and Weinan E

Title: The Knowledge Graph for Macroeconomic Analysis with Alternative Big Data

Markowitz Model

Author: Daniela Hanicova

Title: Markowitz Model

A Deeper Look into Factor Momentum

Authors: Minyou Fan, Youwei Li, Ming Liao and Jiadong Liu

Title: A Reexamination of Factor Momentum:How Strong is It?

Stay safe …

Radovan Vojtko

CEO & Head of Research

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend