Secular Decline in Yields around FOMC Meetings

Federal Open Market Committee meetings (aka FED meetings) have a significant influence on the number of different assets (see for example our article related to drift in equities during FED meetings). The main channel which FED uses to influence the US economy is the level of short term interest rates. Therefore, it’s not a surprise that FED meetings have influence also on long-term interest rates. But just how big? Bigger than most people think. We are presenting one interesting research paper written by Sebastian Hillenbrand, which shows that the whole secular decline in equity yields and long-term interest rates since 1980 was realized entirely in a 3-day window around FOMC meetings. Now, that’s called the influence …

Author: Hillenbrand

Title: The Secular Decline in Long-Term Yields around FOMC Meetings

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3550593

Abstract:

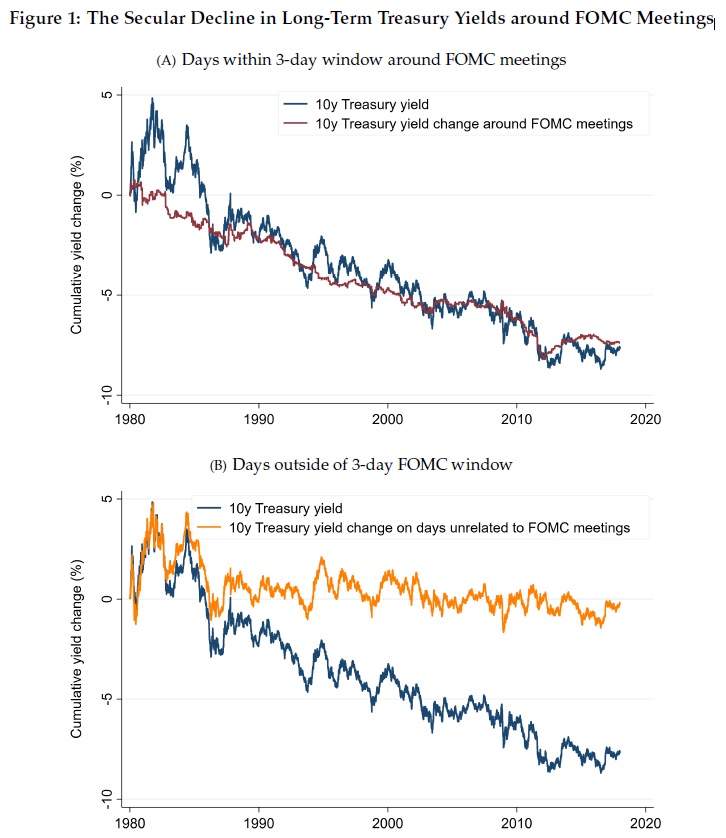

Long-term U.S. Treasury yields fell by almost 8% between 1980 and 2017. I document that the entire decline in long-term interest rates was realized in a 3-day window around FOMC meetings. I find a similar pattern for U.S. equities: the same 3-day window can account for the entire decline in equity yields over the same time period. Decomposing the decline into an expected short-rate and a risk premium component, I find that the fall in long-term yields around FOMC meetings can be mostly attributed to a lower expected path for the future short rate. I argue that these results are surprising in light of theories on monetary policy and the secular decline in interest rates.

Notable quotations from the academic research paper:

“There was a large and persistent decline in long-term yields over the last four decades. The 10-year U.S. Treasury yield decreased from 10.1% at the beginning of 1980 to 2.4% at the end of 2017. During the same time period, the S&P 500 dividend yield fell by 3.7% and the S&P 500 earnings yield by 9.0%.

While the secular decline in long-term yields has important consequences, it is hard to empirically determine its cause. Several theories exist which address the secular decline in interest rates. According to the most prominent explanations, the decline is associated with the idea of secular stagnation and the savings glut – the notion that there is excess savings demand driving down interest rates.

In this paper, I document that the secular decline in long-term interest rates was realized entirely in a 3-day window around FOMC meetings. This 3-day window includes the day of monetary policy decisions as well as the day before and the day after FOMC meetings. More specifically, I find that these days can not only account for the entire decline in the 10-year Treasury yield over the last four decades, but also for the secular decline of two different measures of the equity yield, the dividend yield and the smoothed earnings yield defined as the inverse of the cyclically-adjusted price-to-earnings (CAPE) ratio (Campbell and Shiller (1988)).

The fact that the decline in the 10-year Treasury yield over the last four decades occurred around FOMC meetings suggests that the bond market learned about the secular decline on these days. This fact is unexpected in light of theories on the secular decline in interest rates, such as the secular stagnation and the savings glut hypotheses. These theories argue that the factors that pulled down the Treasury yield over the last decades lie outside the control of the Federal Reserve, making the Fed only react to these outside factors when conducting monetary policy. We typically do not expect the Fed to have superior information about these forces and, as a consequence, monetary policy decisions should not reveal any information about long-run trends in interest rates. The fact that yield movements around FOMC meetings are informative about the secular decline in long-term interest rates is therefore highly surprising.”

Are you looking for strategies applicable in bear markets? Check Quantpedia’s Bear Market Strategies

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend