Equity factors are not as straightforward as they may seem to be. There is an ongoing debate about their usability or expected return since they have a cyclical nature. Moreover, the modern trend of smart beta only fuels this debate. Novel research by Blitz and Hanauer examines the size factor and sheds some light on this elusive anomaly. The size seems to be weak as a stand-alone factor, but it’s far from useless. The academic paper suggests that the size factor can be an important addition to the other equity factors as it helps to unlock the full potential of the quality, value or momentum factors.

Authors: Blitz, David and Hanauer, Matthias Xaver

Title: Settling the Size Matter

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3686583

Abstract:

The size premium has failed to materialize since its discovery almost forty years ago, but is seemingly revived when controlling for quality-versus-junk exposures. This paper aims to resolve whether there exists a distinct size premium that can be captured in reality. For the US we confirm that a highly significant alpha emerges in regressions of size on quality, but for international markets we find that the size premium remains statistically indistinguishable from zero. Moreover, the US size premium appears to be beyond the practical reach of investors, because the alpha that is observed ex post in regressions cannot be captured by controlling for quality exposures ex ante. We also find that the significant regression alpha in the US is entirely driven by the short side of quality. Altogether, these results imply that size only adds value in conjunction with a short position in US junk stocks. However, we also show that small-cap exposure is vital for unlocking the full potential of other factors, such as value and momentum. We conclude that size is weak as a stand-alone factor but a powerful catalyst for other factors.

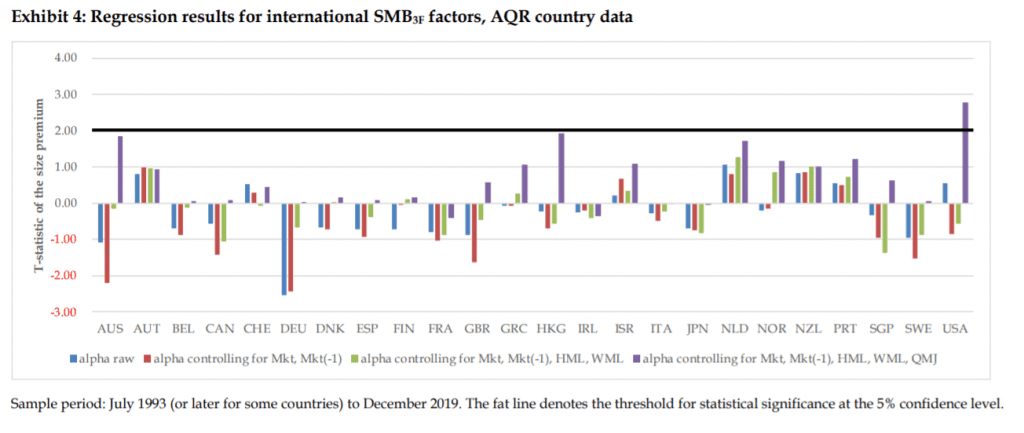

A strong size premium is present in time-series regressions of small minus big portfolio returns on quality factors, but the results suggest that the premium is limited to the US market. The large and statistically significant size premium does not carry over to non-US markets, as shown by the following exhibit from the paper.

Notable quotations from the academic research paper:

“Size can be an important factor for explaining mutual fund returns, and that other factors, such as value, tend to be more powerful among smaller stocks, which might be a reason to overweight small-cap stocks in long-only constrained portfolios. But “simply generically tilting toward small stocks is unlikely to provide much of a premium.”

The SMB portfolio turns out to have a strong negative loading on the QMJ factor, indicating that the average small-cap stock has much poorer quality characteristics than the average large-cap stock. The alpha in the time-series regressions implies that if one accounts for the quality difference between small and large stocks, a highly significant and distinct small-cap premium is, in fact, clearly present in the US stock market.

We confirm the result that a strong size premium emerges in time-series regressions of US small-minus-big portfolio returns on quality(-like) factors. For international stock markets we find that size also loads negatively on quality factors, but that the size premium remains economically small and statistically indistinguishable from zero after controlling for these relations. Thus, the existence of a large and significant size premium is limited to the US market and does not carry over to international markets.

In sum, the added value of size appears to be limited to investors who specifically short US junk stocks. However, this result does not imply that investors should generally strive for size neutrality, in particular when it comes to long-only factor strategies. As also argued by Alquist, Israel, and Moskowitz (2018), the fact that other factors, such as value, tend to be stronger in the small-cap space may justify a structural overweight in small-cap stocks even if the size premium itself is zero. We provide additional empirical support for this argument by showing that the Fama-French factors, which give a weight of 50% to the small-cap segment of the market, have highly significant alphas compared to the same factors without such a disproportionately high weight for small-caps. Thus, a tilt towards small-cap stocks in long-only factor strategies can serve as a powerful catalyst for unlocking the full potential of these other factors.

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend