Every hedge fund manager and every trader wants to know what strategies are employed in a fund ran by his competition. The curiosity is even stronger if we want to see how strategies are mixed in the kitchen of the most successful hedge funds. Top performing funds are usually notoriously secretive about their portfolios. But we still can learn something from the history of their monthly returns. One such interesting methodology is described in a research paper written by Canepa, Gonzalez, and Skinner. Their analysis hints that the top-performing hedge funds are usually successful because they are able to manage their factor exposure better. They are not dependent so much on classical equity risk factors as average funds are. And if they are exposed to some risk factor, the top-performing hedge funds are able to close underperforming factor strategy sooner than average funds.

Authors: Canepa, Gonzales, Skinner

Title: Hedge Fund Strategies: A non-Parametric Analysis

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3499492

Abstract:

We investigate why top performing hedge funds are successful. We find evidence that top performing hedge funds follow a different strategy than mediocre performing hedge funds as they accept fewer risk factors that mostly anticipate the troubling economic conditions prevailing after 2006. Holding alpha performance constant, top performing funds mostly avoid relying on passive investment in illiquid investments but earn risk premiums by accepting market risk. Additionally, they seem able to exploit fleeting opportunities leading to momentum profits while closing losing strategies thereby avoiding momentum reversal.

Notable quotations from the academic research paper:

“First, we examine whether hedge funds have performed as well as several market benchmarks. We find that despite the relatively low hedge fund returns in recent years, the market does not second order stochastically dominate hedge funds from January 2001 to December 2012.

| Do you want to test these ideas yourself? We offer our readers Historical Trading Data Discounts. |

Second, we examine whether top performing hedge funds persistently outperform mediocre performing hedge funds out of sample even if we include the challenging economic conditions of recent years. We find that the top performing quintile of hedge funds does second order stochastically dominate the mediocre performing third quintile out of sample. However, this superior performance persists for only six months, far less than the two or three years reported earlier by authors who use less robust parametric techniques. In any event we conclude that top performing funds persistently outperform mediocre funds for at least six months.

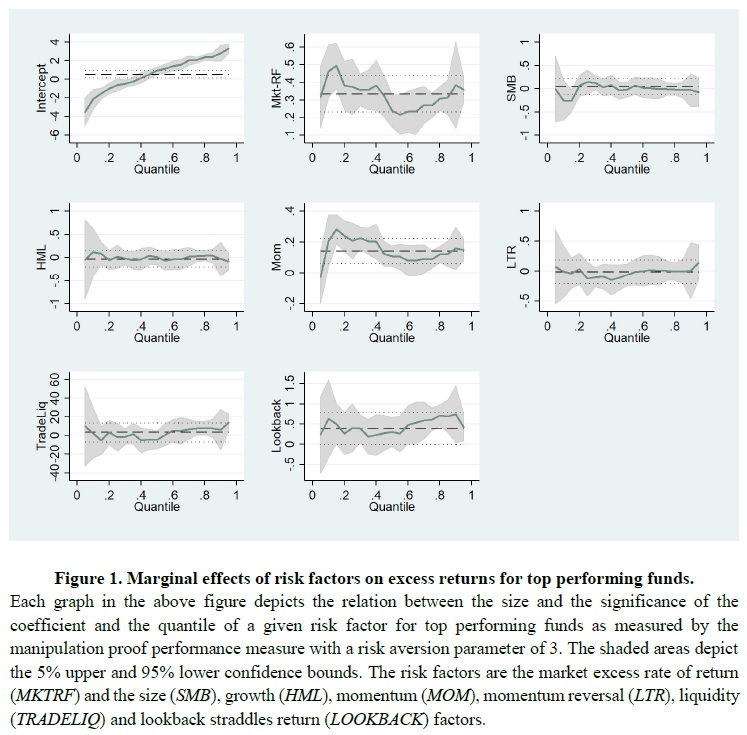

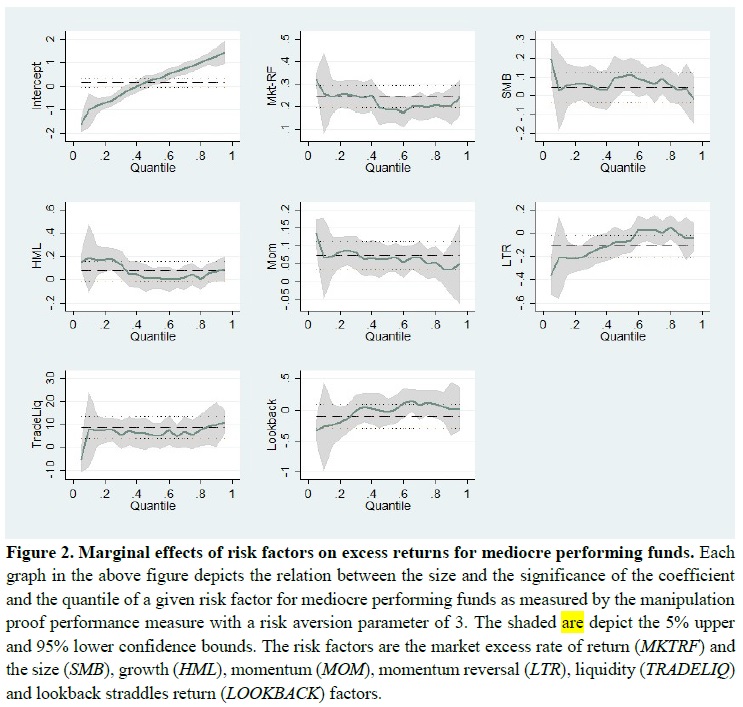

Third, we examine the role liquidity as well as other risk factors, such as momentum, play in achieving net excess rates of return out of sample. We do this for funds of verified superior and mediocre performance to determine whether top performing funds take on a distinctively different risk profile, implying they follow a distinctive strategy, than mediocre performing funds. An important caveat is that we are examining these factors as slope coefficients estimated via quantile regression methods, so we must assume alpha performance is constant.

We find that top performing fund returns are driven by a different risk profile than is evident for more modestly performing funds. Specifically, the excess returns of top performing funds are significantly related to the market premium and momentum across a broad range of quantiles and only for the top quantile, liquidity and lookback volatility. In contrast, the excess returns for mediocre funds are also related to many other factors across a broad range of quantiles including not only the market premium and momentum, but also the SMB and HML Fama French factors. Moreover, unlike top performing funds, liquidity is a significant factor for a broader range of quantiles for mediocre performing funds. Interestingly, momentum reversal is significantly negative for the lowest quantile of mediocre performing funds suggesting that one reason why mediocre funds do less well than top funds is that they are slow to close out a losing strategy.

Are you looking for strategies applicable in bear markets? Check Quantpedia’s Bear Market Strategies

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend