Bitcoin Returns and Volatility Predicted by Bitcoin Exchange Reserves

In the modern world full of technologies, cryptocurrencies are gaining popularity every day. The most famous cryptocurrency, Bitcoin, was introduced in 2009. Ever since its launch and its subsequent success, when within a few years, its price skyrocketed, and it has been the subject of many price predicting studies. These, however, primarily focus on the market and macro factors, entirely omitting the nature of Bitcoin – which is blockchain technology. In the described study, authors Hoang and Baur try to capture and research this interconnection between investors, Bitcoin exchanges, and blockchain.

The easiest way to trade a cryptocurrency is by using an exchange. On such an exchange, the trader has their online wallet, which they use for making transactions. However, these exchange wallets can face different problems, ranging from the risk of being hacked into to the exchange closing and/or running off with their client’s money. Thus, many investors opt for a private wallet. This wallet is not tied to any particular exchange, so it’s much safer. It allows the holder to have their Bitcoin privately stored away from the online dangers. On the other hand, though, when they want to trade their cryptocurrency again, Bitcoin has to be transferred back to the exchange. This moving of funds can be traced, and according to the authors, can be a good indicator of future Bitcoin returns and volatility. It can be said with a fair certainty that the private wallets are indeed preferred by the traders and investors – approximately only around 12% of the Bitcoin in circulation is stored on exchanges, while the rest is in private wallets.

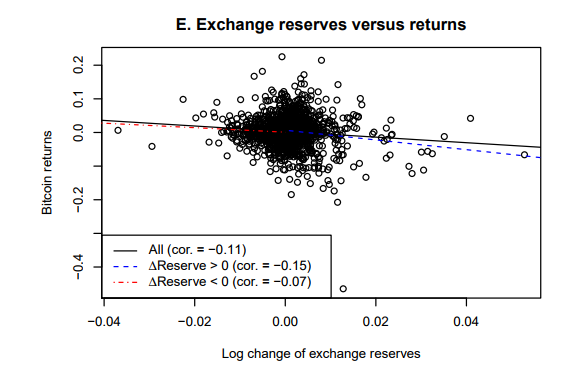

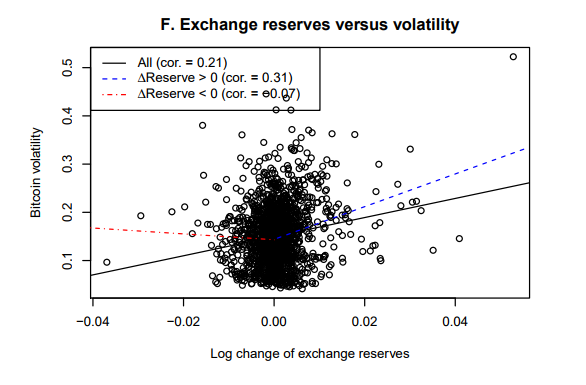

By observing an increased amount of Bitcoin located in exchange reserves, it can be assumed that investors transferred their Bitcoin back to the exchange. In most cases, this means that they plan to sell. Price pressure is created, followed by a negative effect on the Bitcoin price. On the other hand, withdrawing Bitcoins into the private wallets most likely means positive long-term future returns, as the investors are preparing to hold for a prolonged amount of time. This means that long-term returns are associated with (only) decreased exchange reserves, while short-term returns are being influenced by both increasing and decreasing bitcoin exchange reserves. Volatility is positively related to the exchanged reserves.

Authors: Lai T. Hoang, Dirk G. Baur

Title: Effects of Bitcoin Exchange Reserves on Bitcoin Returns and Volatility

Link: https://ssrn.com/abstract=3902504

Abstract: This study shows that changes in bitcoin exchange reserves are negatively related to contemporaneous and future bitcoin returns, consistent with the hypothesis that the transfer of bitcoin on exchanges implies increased price pressure and vice versa. We further identify an asymmetry between positive and negative reserve changes on bitcoin returns and volatility which in turn also affect exchange reserves in extreme market conditions. The results indicate that a significant fraction of bitcoin investors store their wealth off exchanges and only use exchanges to trade. This highlights a special feature of cryptocurrency trading that does not exist in traditional markets.

As always we present some interesting figures:

Notable quotations from the academic research paper:

“This study fills a gap in the literature by investigating price changes as a result of the interaction between bitcoin exchanges, investors and the blockchain. As investors can store bitcoin in their private wallets or in their exchange accounts, movements of bitcoin between the two storage options may provide information of investors’ intention to sell or hold their bitcoins. Investors, especially those who intend to hold their bitcoin over a long period may prefer holding bitcoin in private wallets rather than exchange accounts. This is echoed by the evidence in Figure 1 Panel B that only 12% of total bitcoin in circulation is kept on exchanges and the remaining 88% is stored off exchanges in investors’ private wallets.

Utilizing a unique dataset from CryptoQuant that compiles the bitcoin reserves of 20 leading cryptocurrency exchanges, we find a negative relation between the daily changes of bitcoin exchange reserves and current and future bitcoin returns. Both increased and decreased bitcoin exchange reserves affect short-term returns, but only decreased reserves are associated with positive long-term returns. This is in line with the argument that investors consider exchange accounts as a temporary “bridge” to trade bitcoin on exchanges, and use private wallets to hold bitcoin over longer periods.

We also find effects in the opposite direction from returns and volatility to exchange reserves, but only in extreme market conditions. Specifically, extreme negative bitcoin returns are associated with increases of bitcoin exchange reserves the next day, implying panic selling following market crashes. Meanwhile, during periods of normal volatility, investors transfer more bitcoin to exchange accounts following an increase of price variation but are more reluctant to do so when the market is stable or extremely volatile.

Instead of reflecting the transfers of bitcoin from investors’ private wallets to exchange accounts, it is also possible that an increase of bitcoin exchange reserves is due to exchanges using their own money to buy bitcoin. If this is the case, we should observe a positive relation between reserve changes and bitcoin returns due to the buying pressure from exchanges. However, since our empirical results reveal a negative relation instead, we believe that this effect is small and thus the variation of bitcoin exchange reserves is mainly due to investors transferring their bitcoin on and off exchanges.

To calculate daily exchange reserves, the data vendor identifies addresses of various exchanges on the bitcoin blockchain and tracks the amount of bitcoin transferred to and from those addresses. The sample period spans 1,979 trading days from January 01, 2016 to June 01, 2021. The reserves display an upward trend from the beginning of the sample until mid 2019 when they peaked at around three billion bitcoins. Subsequently, the exchange reserves gradually decreased to around 2.4 billion bitcoins by the end of the sample period.

The proportion of exchange reserves to the total amount of bitcoin in circulation is about 12% on average and exhibits a similar evolution as the level of reserves over time. The relatively small percentage indicates that a large part of bitcoins (88%) is kept off-exchange, in private wallets.

On average exchanges send and receive around 100 thousand bitcoins per day. The number increased significantly in 2017 and became relatively stable recently. In contrast, the total amount of bitcoin transferred on the blockchain markedly decreased after 2018. A possible reason is the increasing popularity of exchanges which allows investors to trade bitcoin off-chain with much lower transaction fees, leading to the observed reduction in direct on-chain trading between two parties. Panel B shows that the ratio of the exchange-related transaction amount to the total transaction amount has increased substantially since 2018, indicating that exchanges are primarily used to buy and sell bitcoin.

We conjecture that when investors load their bitcoins onto the exchanges’ addresses, they are likely to sell them in the very near future affecting short-term returns. On the other hand, investors who transfer their bitcoins from exchanges back to their private wallets likely expect the price to increase in the long term. As a result, a decrease in bitcoin exchange reserves decreases any price pressure and positively affects both short-term and long-term returns. An analogous example would be a supermarket which puts more umbrellas on the shelves when long spells of rain are expected and takes umbrellas off the shelves when long spells of sunny or no rain weather are expected.

Consistent with our hypothesis, the coefficients of ∆Reserve are negative and statistically significant for all horizons, indicating that bitcoin exchange reserves negatively affect bitcoin returns, both contemporaneously and subsequently. Meanwhile, volatility is negatively associated with contemporaneous returns but positively associated with future returns. Bitcoin market capitalization exhibits the opposite pattern, i.e., positively related to returns on the same day but unrelated to returns from the next day. Other variables such as bitcoin liquidity, economic policy uncertainty and stock volatility do not show a clear relationship with bitcoin returns.

Absolute change of bitcoin exchange reserves is positively related to bitcoin volatility. The asymmetric effect indicates that positive changes of exchange reserves have a stronger impact on bitcoin volatility than negative changes. Given our finding that positive changes of exchange reserves are associated with negative returns and negative changes of exchange reserves are associated with positive returns, this result is consistent with a “classical” asymmetric volatility or leverage effect generally observed in equity markets where negative returns increase the volatility by more than positive returns (Glosten et al., 1993).

Among 20 exchanges, Coinbase holds the largest amount of reserves at all times, which accounts for around 25% of total exchange reserves by the end of the sample period. Binance, although founded later than others, exhibits a significant increase of reserves in recent years. Meanwhile, reserves of other well known exchanges such as Bitfinex, BitMex or Poloniex exhibit decreasing reserves over time.

We have treated reserve changes as an exogenous variable and examined how they are related to contemporaneous and future returns and volatility of bitcoin. However, it is also possible that price movements affect investors’ trading behavior and thus the movement of bitcoin between their private wallets and exchange accounts. Such effects have been documented in stock markets. a decrease of bitcoin returns is followed by an increase of bitcoin exchange reserves on the next day, implying panic selling of bitcoin investors during such extreme market conditions. The effect disappears for longer lags and for extremely good market conditions, which is consistent with the panic selling explanation. when market volatility is extremely high or low (i.e., larger than 95% quantile or smaller than 5% quantile), investors are less willing to do so but rather keep holding bitcoin in their private wallets (shown by the negative and significant coefficients of the interaction terms), further highlighting the functional differences between private wallets and exchange accounts.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend