Hello all,

Over the last month, our team has been working on significant expansion of the “Strategy Grading” report to enhance the analysis of the chosen model portfolio (or individual strategy) compared to its peers. This improvement allows Quantpedia Pro clients to better assess the risk and performance of their selected strategy or model portfolio relative to a relevant group of strategies and ETFs, providing valuable insights into the effectiveness of their chosen approach. By enabling these comparisons, you can make more informed decisions about potential adjustments or improvements to your investment strategies.

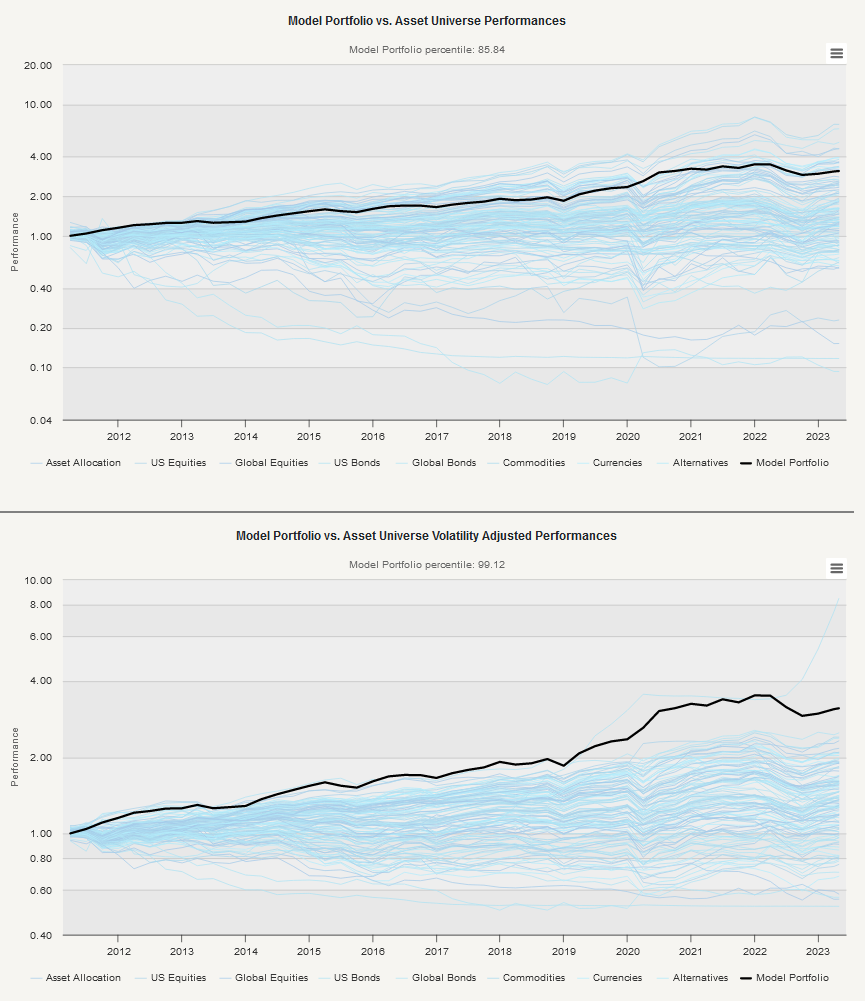

The Model Portfolio vs. Asset Universe (Volatility Adjusted) Performances charts – depict the equity curve of your selected Model Portfolio against its peers (ETFs or Quantpedia’s systematic trading strategies). The chart that shows volatility-adjusted performance rescales competing strategies to the same volatility as the selected Model Portfolio; therefore, it better shows how your portfolio fares against alternatives on a risk-adjusted basis. Of course, the higher the equity curve of your portfolio is, the better.

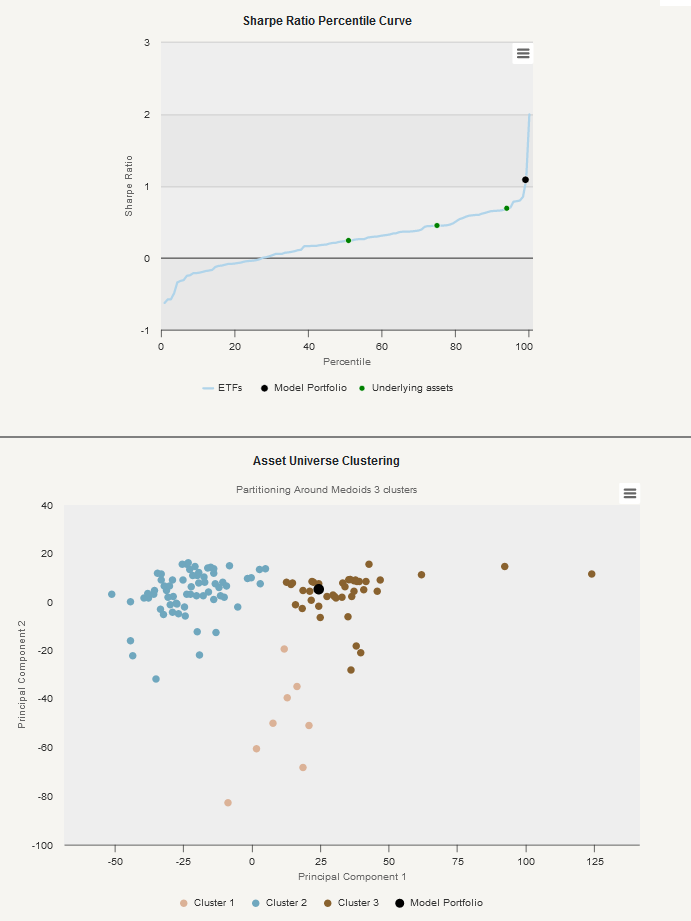

The Sharpe Ratio Percentile Curve chart displays in another way how your Model Portfolio (and its constituents) fares against ETFs or Quantpedia’s systematic trading strategies.

The Asset Universe Clustering uses the Partitioning Around Medoids clustering method to find the clusters in the universe of ETFs (or Quantpedia’s systematic trading strategies) and shows how related is the Model Portfolio to its alternatives.

Let’s also quickly recapitulate Quantpedia Premium development:

- 10 new Quantpedia Premium strategies have been added to our database

- 12 new related research papers have been included in existing Premium strategies during the last month

- 8 new backtests were written in QuantConnect code. Our database currently contains over 670 strategies with out-of-sample backtests/codes.

Additionally, 5 new articles were published on the Quantpedia blog in the previous month, 4x analysis of academic research paper and 1x Quantpedia study:

And here are links to 4x analysis of research papers:

Are Funds Flows Influenced by Mortality?

Authors: Alok Kumar, Ville Rantala, Claudio Rizzi

Title: Mortality, Mutual Fund Flows, and Asset Prices

Political Beliefs Matter for Fund Managers

Authors: Will Cassidy and Blair Vorsatz

Title: Partisanship and Portfolio Choice: Evidence from Mutual Funds

Evaluating Factor Models in China

Authors: Zhiyong Li and Xiao Rao

Title: Evaluating Asset Pricing Models: A Revised Factor Model for China

Price Momentum or Factor Momentum: What Leads What?

Authors: Nusret Cakici, Christian Fieberg, Daniel Metko, Adam Zaremba

Title: Factor Momentum Versus Stock Price Momentum: A Revisit

Yours …

Radovan Vojtko

CEO & Head of Research

Are you looking for more strategies to read about? Visit our Blog or Screener.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Do you want to know more about us? Check how Quantpedia works and our mission.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend