Hello all,

As every month, let me recapitulate the work that we did on Quantpedia in March.

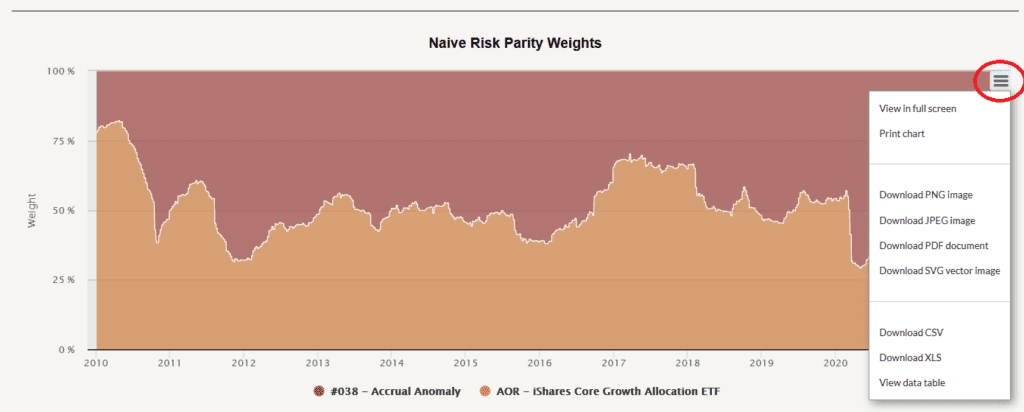

Firstly, I would like to show you the new export feature in the Quantpedia Pro service. Now you can download data as .csv or .xlsx from each Quantpedia Pro report chart for your further analysis. This way, you can use any calculation performed by Quantpedia Pro (be it Markowitz optimization, VaR, DCA, risk parity, CPPI, volatility targeting, clustering or multi-factor analysis) and use it as an input in your work.

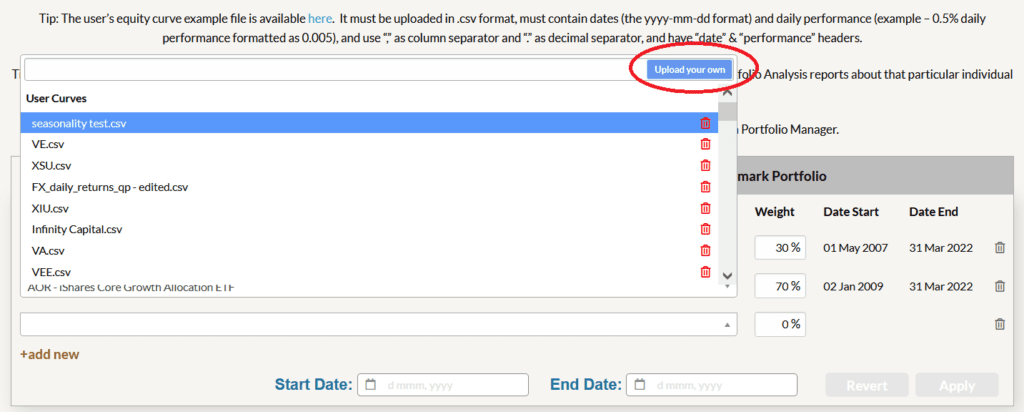

Secondly, we simplified the integration of the Quantpedia Pro service with the Quantconnect backtesting engine. Now you can very easily upload the equity curve of any trading strategy that you backtested in Quantconnect into Quantpedia Pro and then use that strategy as a building block for modeling your multi-factor portfolio. Or you can investigate the trading strategy’s correlation to other factors, perform multi-factor regression, inspect the strategy’s seasonality, trend/reversal overlay, inflation sensitivity, crisis analysis, and much more.

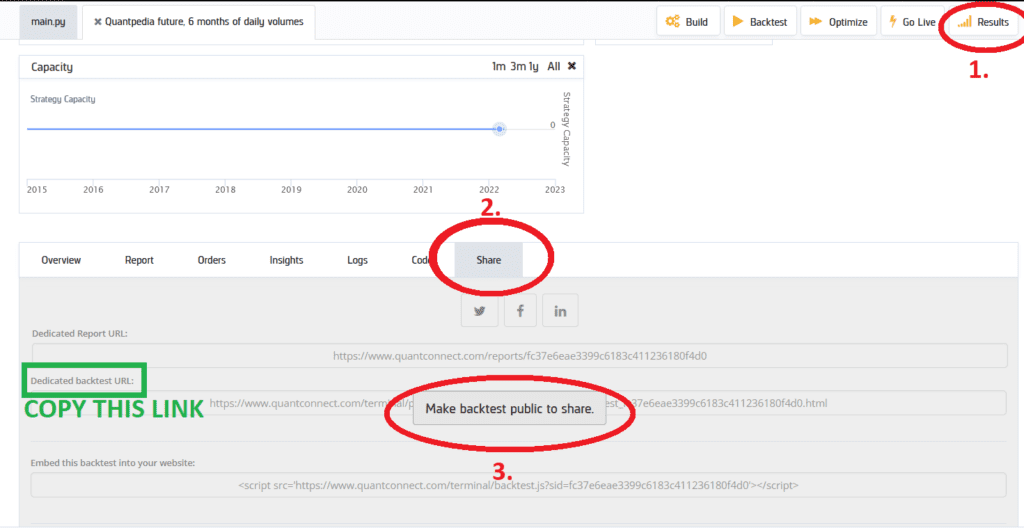

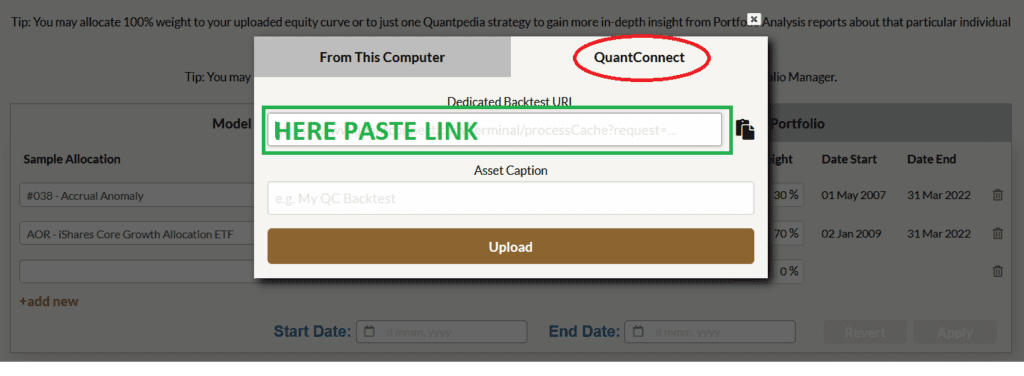

How can you do it? When you have a strategy written in the Quantconnect environment, just go to the Results tab, then to the Share tab, press the button to share results, and copy the strategy’s link.

Then you can paste the link into the Quantpedia Pro import window.

We will import only the backtest strategy’s equity curve; we do not have access to your trading rules or any actual underlying information about realized trades. Only the daily percentual performance of your strategy is uploaded and used to re-create your strategy’s equity curve, which is then used for further analysis.

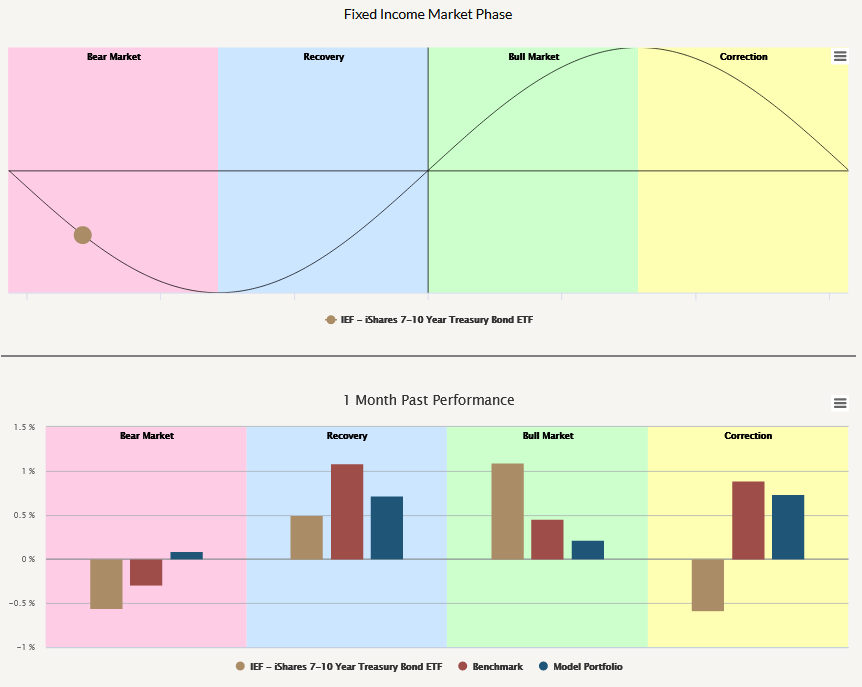

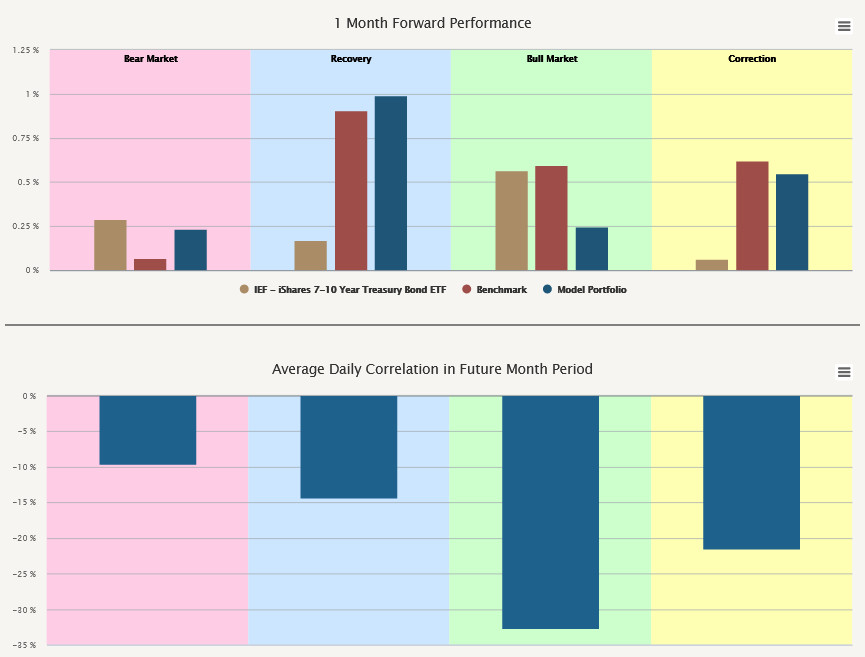

Thirdly, we have a new Quantpedia Pro report for you. In response to higher inflation, the whole world surely moves to a higher interest rate environment. Our new Fixed Income Phases Analysis report will offer you a glimpse into the behavior of your trading strategy or your custom multi-strategy multi-asset portfolio in reaction to moves in the fixed income market. You can analyze past, forward performance, and correlation, plus see how your strategy or portfolio moves in different fixed income market regimes.

Let’s also quickly recapitulate Quantpedia Premium development:

- 10 new Quantpedia Premium strategies have been added to our database

- 12 new related research papers have been included in existing Premium strategies during the last month

- 8 new backtests were written in QuantConnect code. Our database currently contains nearly 550 strategies with out-of-sample backtests/codes.

Additionally, 6 new articles were published on the Quantpedia blog in the previous month, 3x analysis of academic research papers and 3x Quantpedia studies:

- Nuclear Threats and Factor Performance – Takeaway for Russia-Ukraine Conflict

- Trend-following and Mean-reversion in Bitcoin

- Factor Performance in Cold War Crises – A Lesson for Russia-Ukraine Conflict

Analysis of research papers:

Is There Any Hidden Information in Annual Reports’ Images?

Authors: Azi Ben-Rephael, Joshua Ronen, Tavy Ronen, and Mi Zhou

Title: Do Images Provide Relevant Information to Investors? An Exploratory Study

What Can We Learn from Insider Trading in the 18th Century?

Author: Mathijs Cosemans and Rik Frehen

Title: How harmful is insider trading for outsiders? Evidence from the eighteenth century

Full vs. Synthetic Replication and Tracking Errors in ETFs

Author: Xinrui Zheng

Title: Does the Replication Method Affect ETF Tracking Efficiencies?

Yours …

Radovan Vojtko

CEO & Head of Research

Are you looking for more strategies to read about? Visit our Blog or Screener.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Do you want to know more about us? Check how Quantpedia works and our mission.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend