Quantpedia in May 2022

Hello all,

The volatility in financial markets is still elevated, and the macro environment is challenging. Therefore, we continue to build risk management reports for our Quantpedia Pro clients. The latest addition is the Monte Carlo Analysis report, for which we unveiled our methodology approximately a week ago.

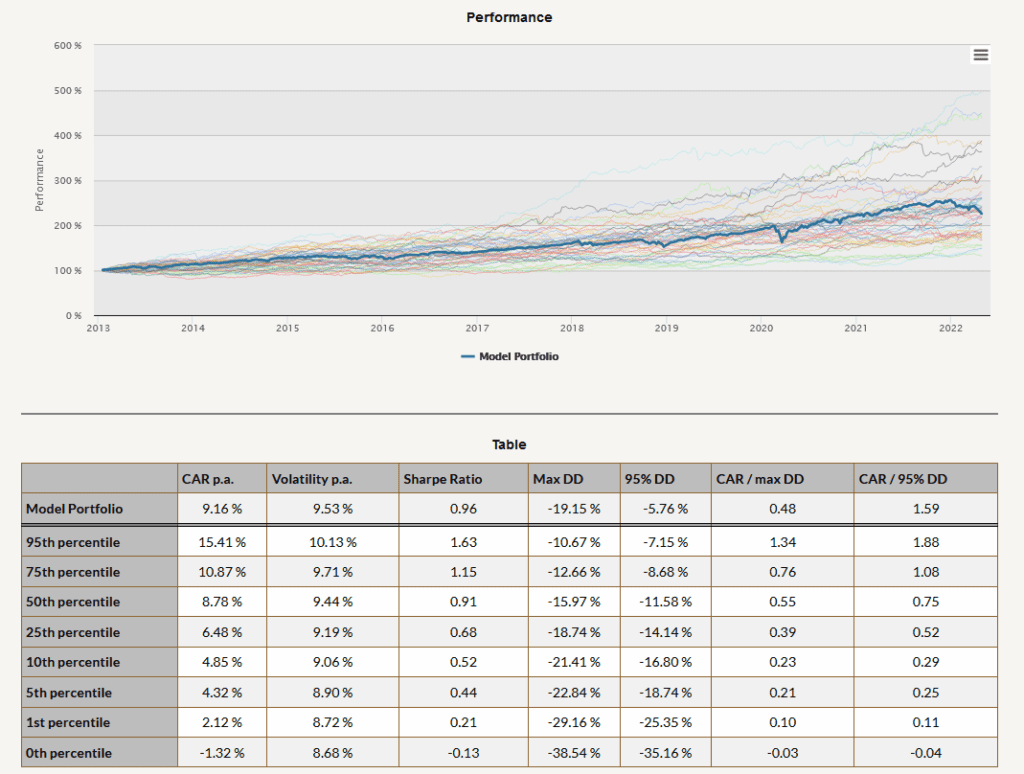

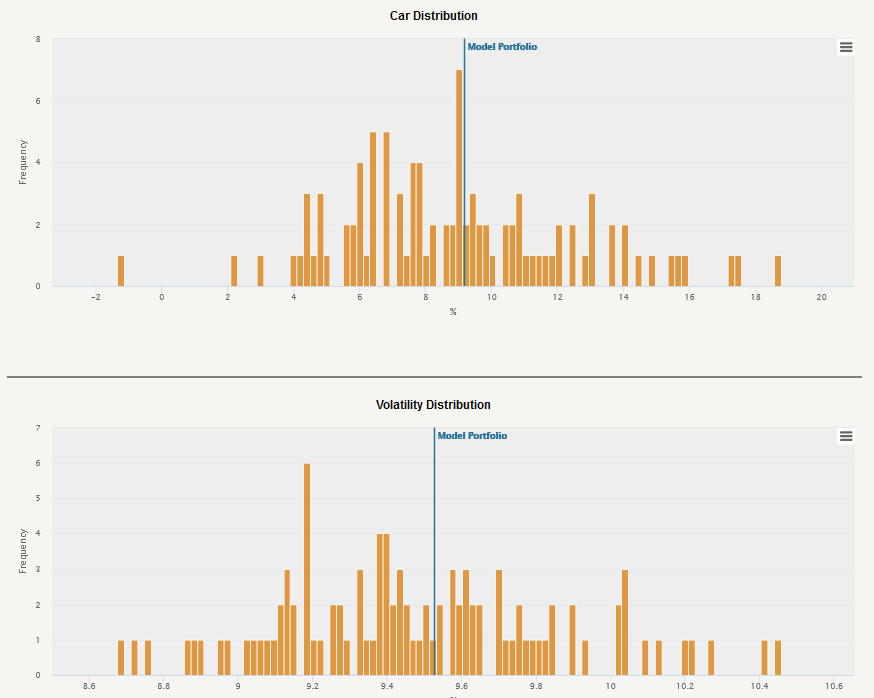

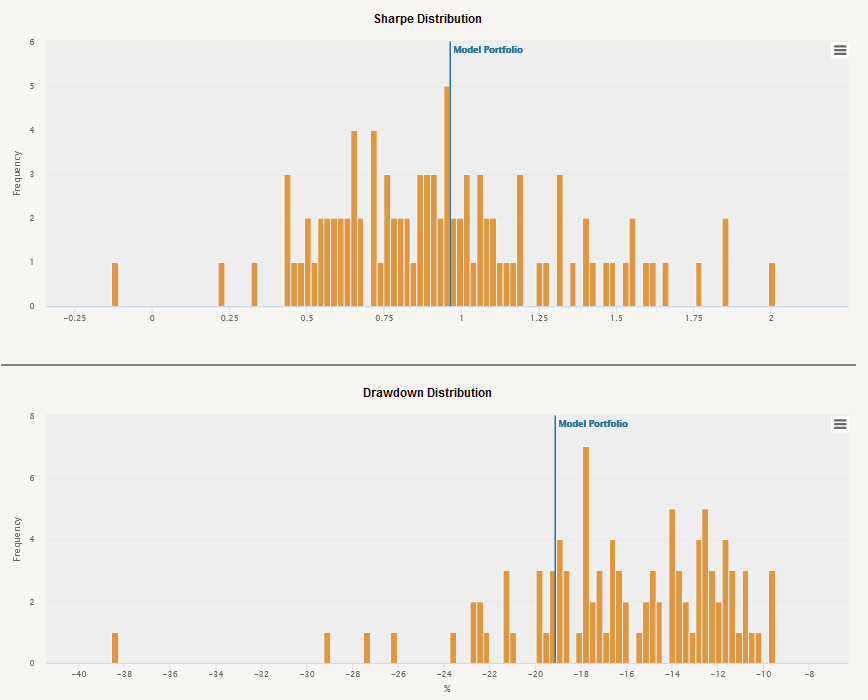

Our report uses Monte Carlo sampling with replacement. We create 100 new alternative histories of your trading strategy (or any model portfolio built in the Portfolio Manager) and review the cumulative returns of the simulated strategies and the 95th, 75th, 50th, 25th, 10th, 5th, 1st, and the 0th percentile of the risk and return characteristics. We suggest paying attention and analyzing the worst-case scenarios (10th, 5th, 1st, and the 0th percentile).

Let’s also quickly recapitulate Quantpedia Premium development:

- 9 new Quantpedia Premium strategies have been added to our database

- 15 new related research papers have been included in existing Premium strategies during the last month

- 10 new backtests were written in QuantConnect code. Our database currently contains nearly 570 strategies with out-of-sample backtests/codes.

Additionally, 8 new articles were published on the Quantpedia blog in the previous month, 3x analysis of academic research papers and 5x Quantpedia studies:

- Extending Historical Daily Bond Data to 100 Years

- Best Performing Value Strategies – Part 1

- Extending Historical Daily Commodities Data to 100 Years

- 100-Years of Multi-Asset Trend-Following

- Introduction and Examples of Monte Carlo Strategy Simulation

Analysis of research papers:

Carbon Futures – Emerging Asset with Hedging Benefits

Authors: Sercan Demiralay, Gaye Hatice Gencer, Selcuk Bayraci

Title: Carbon Credit Futures as an Emerging Asset Hedging, Diversification and Downside Risks

How Often Should We Rebalance Equity Factor Portfolios?

Authors: Emlyn Flint, Rademeyer Vermaak

Title: Factor Information Decay: A Global Study

Grading and Merging ESG Scores from Multiple Providers

Author: Invest Verte

Title: Invest Verte Framework

Yours …

Radovan Vojtko

CEO & Head of Research

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend