Quantpedia in November 2021 – Benchmark Portfolio & Partners’ Discount Coupons

Hello all,

As usual, let me use this space to recapitulate what’s new in November’s update of Quantpedia’s services. The most interesting addition has been built for Quantpedia Pro‘s Portfolio Manager, which now allows you to construct a Benchmark Portfolio to complement your Model Portfolio allocation.

This feature speeds up the research process as you can now set up one default multi-strategy multi-asset portfolio as your Benchmark and then test various small changes and variations of your allocation in your Model Portfolio. Information about Benchmark allocation is directly used in a lot of Quantpedia Pro reports, such as Basic Overview, Crisis, Trend/Reversal, and Market Phases Analysis or different asset allocation reports like Volatility Targeting or Portfolio Risk Parity.

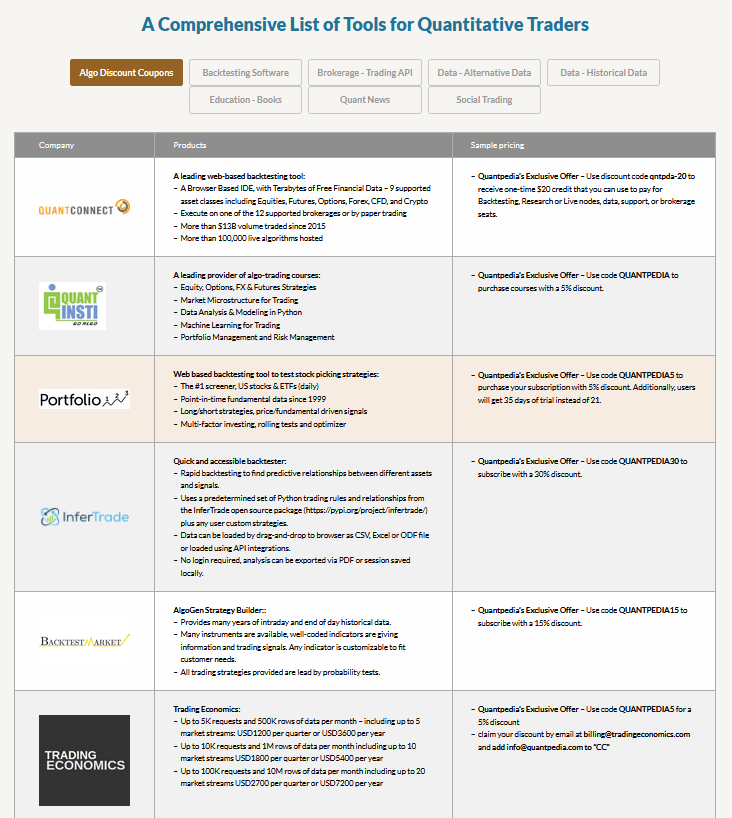

The second interesting addition is a part of our free content in the “Resources” sub-page. We would like to let you know about a new table in the Links section. The new “Algo Trading Discounts” table compiles discounted offers that we were able to negotiate exclusively for our readers with some of our partners that service the algo&quant trading community.

Let’s also quickly recapitulate Quantpedia Premium development:

- 10 new Quantpedia Premium strategies have been added to our database

- 10 new related research papers have been included in existing Premium strategies during the last month

- 10 new backtests were written in QuantConnect code. Our database now contains over 500 strategies with out-of-sample backtests/codes.

Additionally, 7 new articles were published on the Quantpedia blog in the previous month, 5x analysis of academic research papers and 2x Quantpedia studies:

- Community Alpha of QuantConnect – Part 4: Composite Social Trading Multi-Factor Strategy

- How to Combine Different Momentum Strategies

Analysis of research papers:

Out-of-Sample Dataset Before the “Sample”: Pervasive Anomalies Before 1926

Authors: Guido Baltussen, Bart P. Van Vliet and Pim Van Vliet

Title: The Cross-Section of Stock Returns before 1926 (And Beyond)

The Quant Cycle – The Time Variation in Factor Returns

Author: David Blitz

Title: The Quant Cycle

How News Move Markets?

Authors: Mark Kerssenfischer and Maik Schmeling

Title: What Moves Markets?

Bitcoin Returns and Volatility Predicted by Bitcoin Exchange Reserves

Authors: Lai T. Hoang, Dirk G. Baur

Title: Effects of Bitcoin Exchange Reserves on Bitcoin Returns and Volatility

What Drives Volatility of Bitcoin?

Authors: Štefan Lyócsa, Peter Molnár, Tomáš Plíhal and Mária Širaňová

Title: Impact of macroeconomic news, regulation and hacking exchange markets on the volatility of Bitcoin

Happy trading …

Radovan Vojtko

CEO & Head of Research

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend