Hello all,

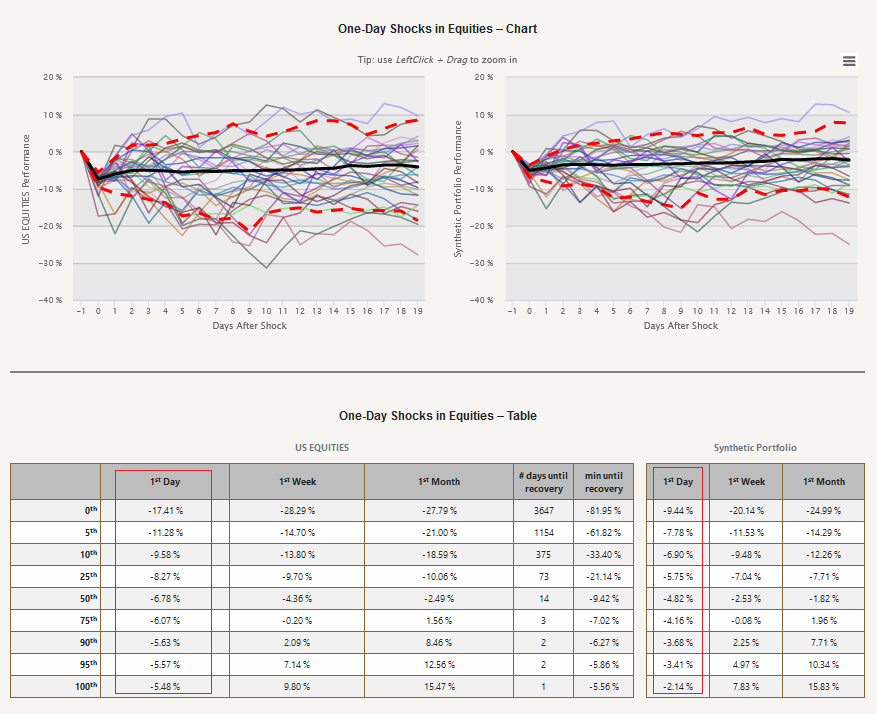

We continue to build Quantpedia Pro reports that use the 100 years data repository we assembled over the last few months. The November’s report is based on the idea from the research article The Worst One-Day Shocks and The Biggest Geopolitical Events of the Past Century. The report will give you the opportunity to review the market performance of 3 different assets (US equities, 10Y treasury bonds and commodities) after the 30 worst one-day shocks in each asset over the last century. You can investigate market reactions visually and also check the table with percentile returns after the events (charts and tables on the left side).

Additionally, we use the same methodology as in the 100yrs Portfolio Analysis report, create a 100 years history of synthetic portfolio based on your Model Portfolio and you can also review the market reaction of your portfolio on those one-day shocks (charts and tables on the right side).

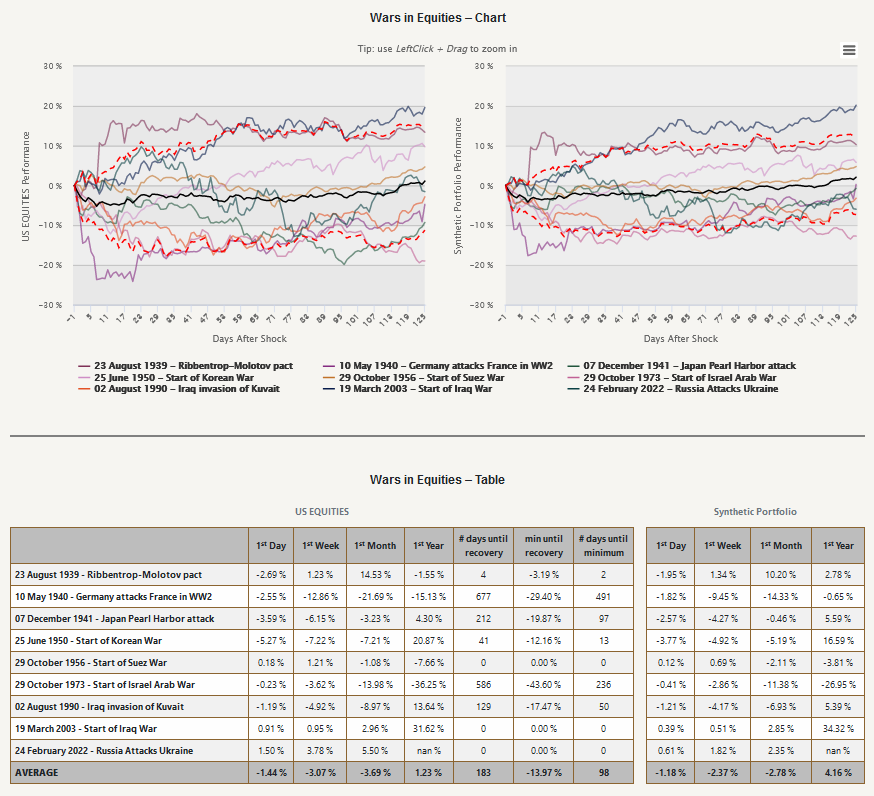

The second part of the report focuses on critical geopolitical events (the start of major wars, international crises, and deterioration of US presidents’ health) and their effect on bonds, stocks, commodities and your Model Portfolio. Once again, you can review market reactions visually and check the average performance after each event in the summary table.

Let’s also quickly recapitulate Quantpedia Premium development:

- 10 new Quantpedia Premium strategies have been added to our database

- 13 new related research papers have been included in existing Premium strategies during the last month

- 10 new backtests were written in QuantConnect code. Our database currently contains over 620 strategies with out-of-sample backtests/codes.

Additionally, 5 new articles were published on the Quantpedia blog in the previous month, 1x analysis of academic research paper and 4x Quantpedia study:

- How to Paper Trade Quantpedia Backtests

- Reviewing Patent-to-Market Trading Strategies

- Impact of Dataset Selection on the Performance of Trading Strategies

- A Simple Approach to Market-Timing Strategy Replication

And an analysis of research paper:

How Much Are Bitcoin Returns Driven by News?

Author: Oksana Bashchenko

Title: Bitcoin Price Factors: Natural Language Processing Approach

Yours …

Radovan Vojtko

CEO & Head of Research

Are you looking for more strategies to read about? Visit our Blog or Screener.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Do you want to know more about us? Check how Quantpedia works and our mission.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend