Finally, what are the five top-performing quantitative trading strategies of 2021?

In part 1 of our article, we analyzed tendencies and trends among the Top 10 quantitative strategies of 2021. Thanks to Quantpedia Pro’s screener, we published several interesting insights about them.

In part 2 of our article, we got deeper into the first five specific strategies, which are significantly outperforming the rest in 2021.

Today, without any further thoughts, let’s proceed to the five single best performing strategies of 2021 as of August 2021. Transaction costs and bid-ask spreads are included in all of the charts below.

Top 5 performing strategies of 2021

#5 COT Report Predicts Prices of Agricultural Commodities

YTD performance: +45.11%

Assets: Commodity futures

# Instruments: 6 agricultural

Frequency: Weekly

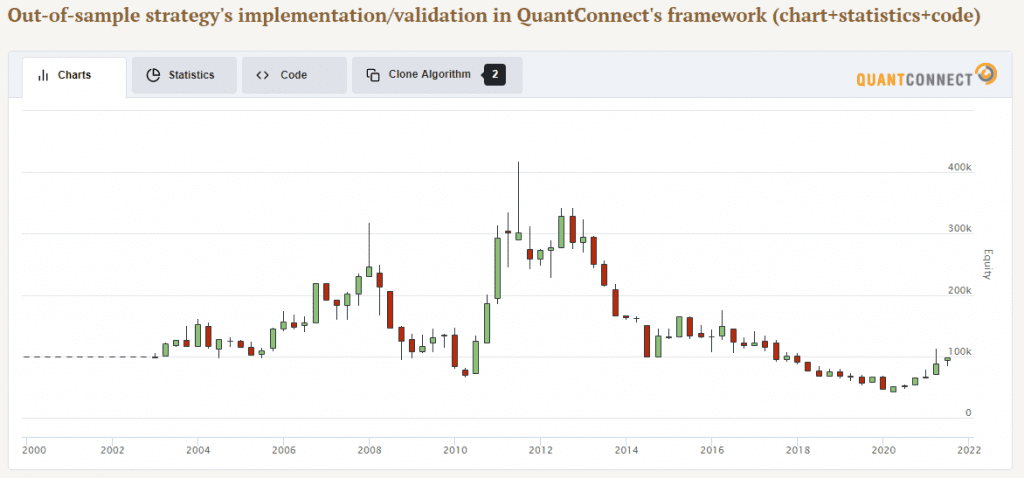

Max Drawdown: -89.8%

Strategy idea: long-short commodities with bullish-bearish speculator and bearish-bullish hedger sentiment

Strategy #5 in our list of best-performing strategies is yet another entirely different from all the other ones in the list. More specifically, it is based on sentiment in the trading of agricultural commodity futures.

Sentiment strategies are gaining more and more popularity recently, especially due to wide-spreading social media trading. Social media, however, is definitely not the only sentiment measure. There are actually a plethora of various sentiment surveys and measures, which may carry an alpha in predicting asset prices. One such example is the COT report.

Based on the information contained in the COT report, one may try to predict the price development of associated commodities. COT report presents information about the positions of hedgers and speculators in each individual commodity.

COT report strategy presented here was struggling strongly in the last few years (as commodity market overall); however, it started 2021 off the strong foot, and it’s been recovering its past losses gradually. It made it to the top 5 quantitative strategies of 2021.

#4 Net Current Asset Value Effect

YTD performance: +53.52%

Assets: US stocks

# Instruments: 3000+ US stocks

Frequency: Yearly

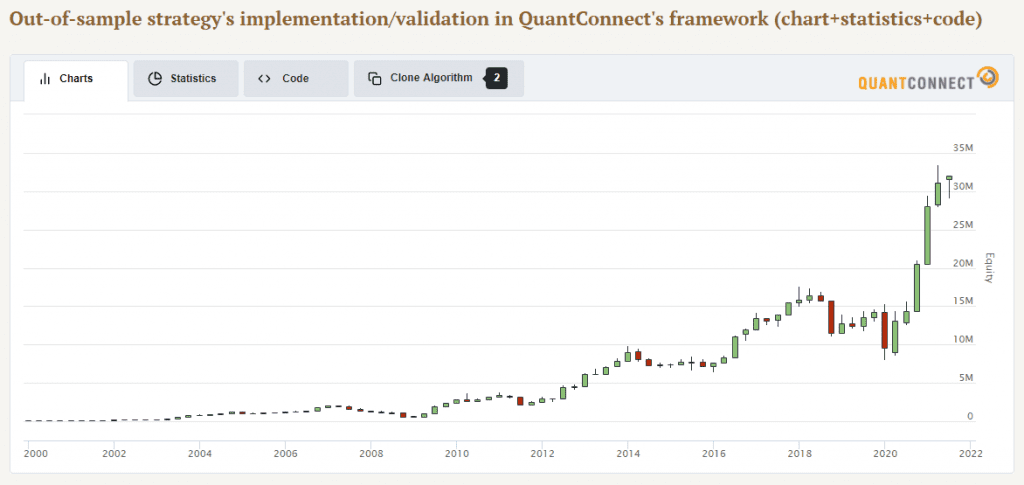

Max Drawdown: -76.2%

Strategy idea: long high NCAV stocks

Several quantitative strategies based on fundamentals have recently been experiencing difficult times with lackluster performance along with Value strategies. That being said, not all fundamental strategies are doing badly. There are actually multiple trading strategies based on fundamental factors which perform greatly.

The strategy which made it to #4 of our ranking is trading US equities, and its main idea is based on holding high net current asset value stocks. Strategy is very simple to understand and easy to implement. Net current asset value effect strategy has a spectacular run-up since 2020 and belongs to one of the best performing strategies of recent years.

#3 The 52-Week High and Short-Term Reversal in Stock Returns

YTD performance: +77.35%

Assets: US stocks

# Instruments: 1000+ NYSE, AMEX and NASDAQ stocks

Frequency: Monthly

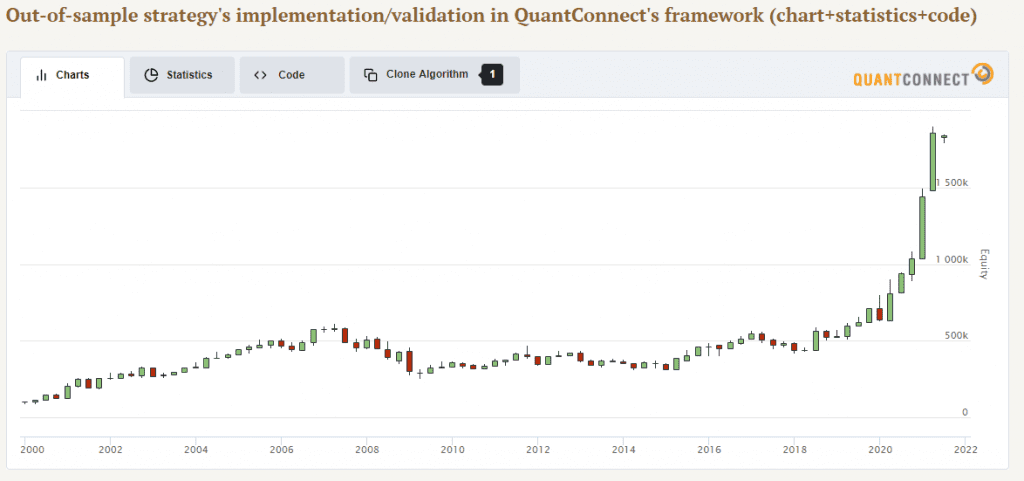

Max Drawdown: -58.9%

Strategy idea: long-short short-term losers-winners far from highs

Stock reversal strategies may work much better when applied to specific subsets of the equity universe or when combined with other factors. Precisely this is the case with the 52-week high and short-term reversal in stock returns strategy. It combines the nearness of a stock to its high with the effect of a stock’s short-term reversal.

This strategy has had an outstanding performance in recent years. Its outperformance had even begun more than four years ago. This makes the strategy even a stronger candidate for one of the best strategies of 2021.

The strategy has been working well even when applied to large-cap stocks and even after transaction costs and bid-ask spreads. Thus, it may serve as valuable inspiration for a quantitive equity portfolio manager.

#2 Profitability Factor Combined with Value Factor

YTD performance: +79.63%

Assets: US stocks

# Instruments: 500 largest

Frequency: Yearly

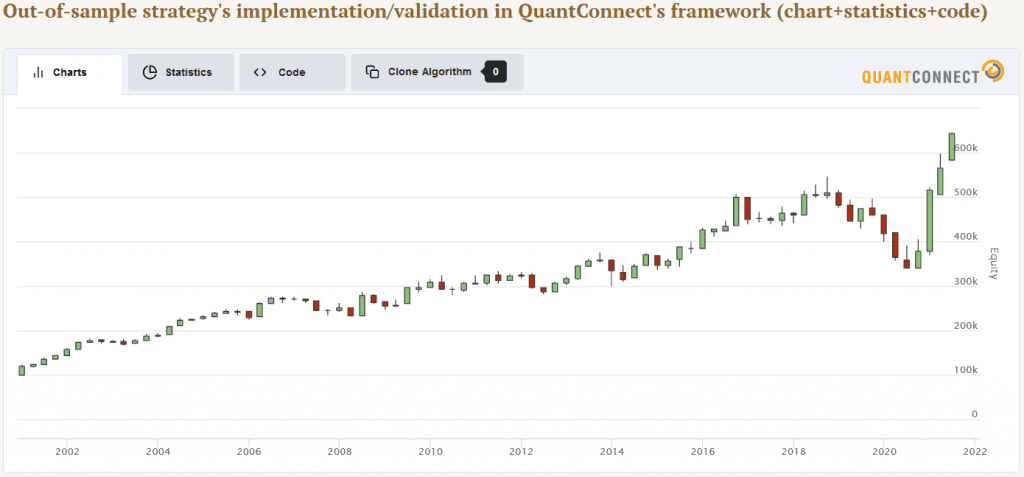

Max Drawdown: -37.6%

Strategy idea: long-short high-low combined value+profitability rankings

Although Quantpedia’s database of 650+ quantitative strategies contains many complex strategies based on, e.g. machine learning, this year seems to favour simpler strategies.

Examples of such a strategy are two well-known factors in the investment community – Value and Profitability. Factors, when combined correctly together, resulted in the 2nd best-performing strategy of 2021. Interestingly, the strategy trades only large-cap stocks, where the room for alpha seems to be much thinner compared to broader universes.

That being said, a strong alpha of 2021 doesn’t come without risks. The strategy experienced a strongly negative performance in previous years, and it’s now making up for its past losses. That pace at which it’s doing that is, however, strong.

#1 Trend Factor in China

YTD performance: +108.97%

Assets: Chinese stocks

# Instruments: Chinese ADRs on NYSE, AMEX and NASDAQ (original paper uses 500+ Shanghai and Shenzen A-shares)

Frequency: Monthly

Max Drawdown: -82.3%

Strategy idea: long-short highest-lowest expected return quintile based on the trend signal among largest stocks

Apparently, not all China has struggled in 2021. Trend factor in Chinese stocks has actually, as of August, become the best strategy of 2021.

The original paper advocates using 500+ Shanghai and Shenzen A-shares. We do not have access to all data needed for this strategy, so we use liquid ADRs listed on NYSE, AMEX and NASDAQ.

This time, the strategy is slightly more complex, but the main idea is still connected to buying stocks in positive and selling stocks in negative trends. Yes, the performance of this factor strategy variant has fluctuated a lot in recent years (and it definitely didn’t make it to the list of top strategies a few years ago). However, exactly this illustrates the point of being able to adapt to ever-changing market conditions constantly.

Conclusion

Contrary to the optimistic headings, the aim of this series of articles was NOT to find the best strategies ever. We all know that such strategies do not exist. The objective of the series was even NOT to find the best strategies for the rest of 2021. Even this is impossible to predict.

Our main goal was to illustrate how markets (and quantitative strategies together with them) constantly change. We wanted to inspire you to find new ideas for your next investment strategies. Our plan was to show that there are multiple – entirely different – strategies, which may work well even in such a hard-to-predict environment as the year 2021 definitely is.

With Quantpedia’s constantly growing database of 650+ quantitative trading strategies, we strive hard to provide you inspiration for your future strategies. If we succeeded at least a little, we are immensely happy.

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend