YTD Performance of Crisis Hedge Strategies

After a month, we are back with a year-to-date performance analysis of a few selected trading strategies. In the previous article, we were writing about the performance of equity factors during the coronavirus crisis. Several readers asked us to take a look also on different types of trading strategies, so we are now expanding to other asset classes. We picked a subset of strategies that can be used as a hedge at the times of market stress (at least, that’s what the source academic research papers indicate) and checked how they fared.

The situation compared to a month ago is still very hazy. The US unemployment started to decrease, and economic activity is rising again. The enormous amount of stimulus from governments and central banks is flowing into the market what saved many companies from bankruptcy, helped consumers to maintain at least a partial level of their spending and funded the stock market rally. On the other hand, in some developed countries (including in the US), the threat of the second wave of infection spread starts to emerge. And unfortunately, in a lot of the emerging countries, the situation is even worse. They are at the moment experiencing the full load of the first wave of the coronavirus for which they are much less prepared.

Therefore, in these mixed times, we have run a “Crisis hedge” screen among the “Free” strategies and picked a following four futures-based trading strategies: Currency Factor Momentum, Time Series Momentum Effect, Momentum Effect in Commodities and Skewness Effect in Commodities.

Currency factor momentum is a widely observed feature that many currency exchange rates trend on a short-term basis. Therefore, a strategy that follows the trend typically makes positive returns over time. Additionally, currency momentum has a low correlation to traditional equity market momentum. Our trading strategy is based on a basket of 8 liquid currency futures (Australian Dollar, Canadian Dollar, British Pound, Euro, Japanese Yen, Mexican Peso, New Zealand Dollar and Swiss Franc). The investment universe is sorted based on a 12-months momentum, and investor goes long three and goes short three currency futures. The portfolio is equally weighted, and rebalancing is based on a monthly basis.

Time Series Momentum Effect is a remarkably stable and robust strategy, yielding a nice Sharpe ratio with little correlation to passive benchmarks. Returns of this factor appear to be higher in the times of higher volatility, so it should fit well as a hedge. The investment universe consists of 66 commodity futures split among multiple asset-classes (commodities, currencies, equities and fixed income). Every month, the investor goes long futures with positive performance over the last 12-months period and short futures with negative performance. The portfolio is inverse-volatility weighted.

Momentum Effect in Commodities is similar to a momentum strategy in currencies. The investment universe consists of 26 commodity futures contracts. Every month, investor ranks the performance of futures contracts for each commodity for the last 12 months and divides them into quintiles. Then he buys the quintile of futures with the highest momentum and goes short the quintile of futures with the lowest momentum. The portfolio is equally weighted and rebalanced on a monthly basis.

Skewness Effect in Commodities shows that total skewness matters to the pricing of an asset, where assets with higher degrees of skewness or lottery-like features should earn lower expected returns. The strategy has a significantly negative correlation to the equity market; therefore, it probably can be used as a hedge/diversification to equity market risk factor during bear markets. The investment universe consists of 26 futures contracts on commodities. Each month, investor calculates skewness (3rd moment of returns) from daily returns from data going 12 months into the past for all futures. Commodities are then sorted into quintiles and investor goes long quintile containing the commodities with the 20% lowest total skewness and short quintile containing the commodities with the 20% highest total skewness. The resultant portfolio is equally weighted and rebalanced each month.

Some strategies (as currency momentum) can be significantly less volatile than others (for example, two commodity-based). Therefore, as the last step in each strategy, we apply a 10% volatility targeting rate on the portfolio level for all strategies, because we want to compare them on a risk-adjusted basis.

Performance analysis

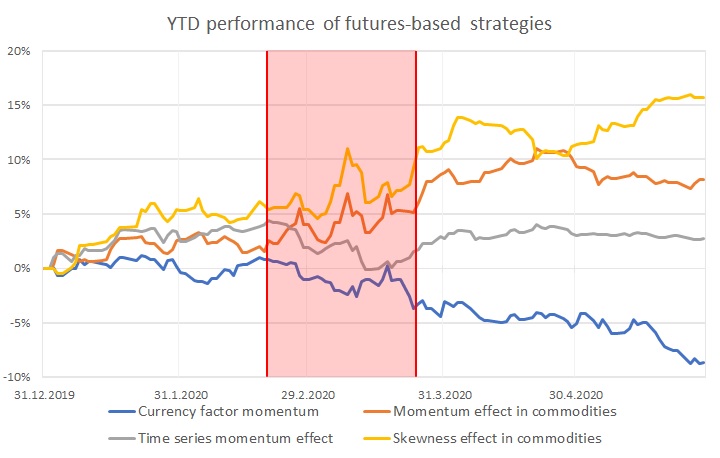

The following analysis is based on a period of 12/31/2019 to 5/31/2020.

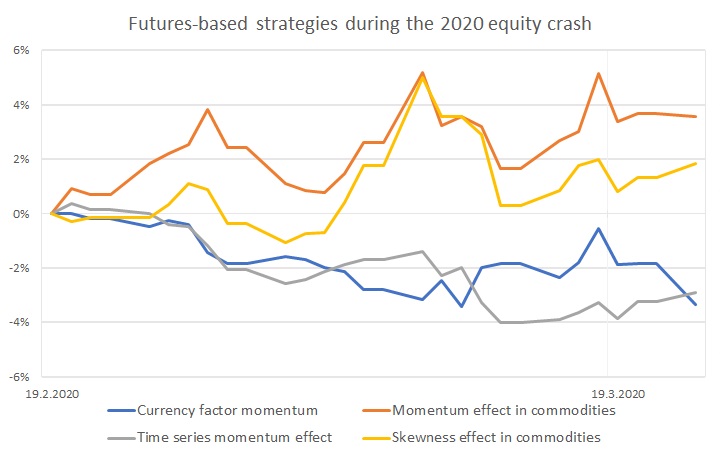

How does the performance over the last several months look like? Three out of four strategies were in green numbers; one is not. The red area in a chart shows the time during which equity indexes were in a free-fall (19th of February to 23rd of March). Let’s zoom only into this period.

Skewness effect in commodities is one of the winners of the year 2020. Factor strategy had a significantly negative correlation to the equity risk factor, performed well before the crisis, during equity crash and even after it and recorded a gain of over 15% on YTD basis.

Momentum effect in commodities performed almost the same as the skewness effect in commodities except for the weaker performance in a post-crash period.

Time-series momentum effect performed well before the crisis, it was not able to hold onto gains during equity market crash but caught up after the crash.

The only loser – Currency factor momentum performed neutrally until the crisis, during which turned negative. During the recovery, the negative performance continued, and this factor was in over -8% drawdown as of 5/31.

Conclusion

The equity crash of 2020 was exceptionally fast. The S&P 500 index lost over -30% in the course of just 23 trading days. Commodity skewness and momentum factors were positioned correctly and were able to profit from this type of movement. Time-series momentum strategy was too slow and was not able to readjust strategy’s weighting fast enough to profit from the fall of equity markets, but still held well this year. Unfortunately, the year 2020 is not a lucky one for currency momentum factor. Currency momentum performed very well in 2008, but it seems that the current environment is not very generous for this strategy.

Authors:

Radovan Vojtko, CEO & Head of Research, Quantpedia

Dominik Cisar, Quant Analyst, Quantpedia

Are you looking for strategies applicable in bear markets? Check Quantpedia’s Bear Market Strategies

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend