Bitcoin in a Time of Financial Crisis

This is the article we had prepared around 1-2 weeks ago (data sample starts in October 2014 and ends on 4th of March 2020). But then coronavirus hit our country (Slovak Republic), and we were doing a lot of crisis management tasks and therefore were not able to publish it on time. Now, after the Bitcoin‘s negative performance between 5th of March and current date, the conclusion of our short article seems logical. But we still feel that it makes sense to publish it in a way it was prepared.

Introduction

Cryptocurrencies – a new asset which emerged in 2009 when the Bitcoin was created became widely known in the middle of the last decade as an interesting alternative to traditional national fiat currencies like the US Dollar or Euro. Early adopters and enthusiasts praise cryptocurrencies for their independence from any monetary authority and low transaction cost and forecast a bright future as an independent medium of exchange and store of value. The first one, the most popular and the most liquid cryptocurrency, is the already mentioned Bitcoin (you may visit Crypto Head if you would like to learn more about how to invest in cryptocurrency markets).

One of the very often promoted attributes of Bitcoin is said to be its “safe heaven” characteristic. Some cryptocurrency proponents advocate that Bitcoin can be used as a store of value mainly during the economic and financial crisis. We argue that it’s not so.

Bitcoin (and all cryptocurrencies too) is, in our opinion, fundamentally more similar to stocks of small companies from the technological sector. It is a very speculative bet on blockchain technology. It may seem unrelated to the broader equity market (like the S&P 500 index) during normal times. But when a stressful time comes, investors are more concerned to meet a deadline for the next mortgage payment. This is the time when the speculative bets are closed, and cash is raised. And this is precisely the time when Bitcoin falls as equities do too.

We would like to point our readers to two more research papers which have the same conclusion. The first paper is from Jo, Park and Shefrin in which they conclude that Bitcoin returns resemble returns of high sentiment beta stocks. The second paper is from Klein, Hien and Walther, and they analyze the properties of Bitcoin as a portfolio component and find no evidence for hedging capabilities.

The usual “safe heaven” assets are gold, sovereign bonds of stable countries (like the US Treasuries) and simple cash in currencies as the Swiss franc, Japanese yen and US dollar. These assets have a long, established history and their behaviour suggest they are stable and retain or even increase in value during market stress times like recessions or black swan events. During market downturns, investors are seeking to gain exposure to these assets to protect their portfolios from severe losses.

From this definition, Bitcoin should be stable and possess the same behaviour like mentioned “safe heaven” assets to be compliant with the theory of a Bitcoin as an asset in which we would like to store our wealth in the market stress times. Bitcoin is not stable; it has high volatility. But maybe it can retain its value in a time of stress. What is the behaviour of Bitcoin when the equity market is in uptrend or downtrend?

Bitcoin behavior in comparison to other assets

As we have mentioned before, we want to perform a very simple analysis to see how Bitcoin behaves in a time of crisis and in a strong bull market. How do we define the crisis period?

It is possible to use NBER definition of a recession (or any other definition based on macroeconomic data), but information from macroeconomic sources usually come with a lag. Therefore we will use the S&P 500 Index movements to assess if financial markets are in stress/recession. We calculate the rolling monthly performance of SPY ETF since the year 2014 (when the Bitcoin started to be considered as a viable investment asset class). Then we define the “uptrend months” as months with SPY performance higher than 90th percentile of the historic monthly performance of the SPY ETF. And vice versa, we define the “downtrend months” as months with SPY performance lower than 10th percentile of the historic monthly performance of the SPY ETF.

The other assets we evaluate in relationship to Bitcoin are Gold (GLD ETF), US Treasury Bonds (7-10 Year Treasury Bonds represented by IEF ETF) and USD (USD index represented by UUP ETF). We calculate an average rolling monthly performance in the uptrend and downtrend months separately to show their characteristics. Our analysis is for the period ranging from October 2014 to March of 2020.

Enough talking. Let’s check the results. Is our conclusion similar to papers written by Jo, Park, Shefrin and Klein, Hien, Walther?

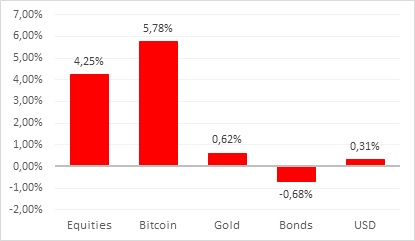

As our analysis of uptrend months in Figure 1 shows, the behaviour of Bitcoin is very similar to equities represented by the SPY ETF. The Bitcoin’s price is on average moving in the direction of the equity market but with a higher dynamic. Moves of other asset classes are on average, much lower because of their lower volatility compared to Bitcoin’s and price movements are in both directions.

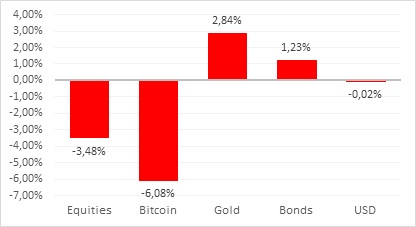

In the second situation, downtrend months, Bitcoin also behaves in line with equities. The bottom percentile performance of the S&P 500 Index (represented by SPY ETF) shows loss of -3,48%. Bitcoin’s rolling monthly performance shows similar behaviour, but with the almost doubled level of negative performance – -6,08%, caused by its high volatility. On the other hand, the “safe heaven” assets as gold and bonds exhibited contradictory behaviour and jumped by 2,84% and 1,23% respectively. This movements perfectly characterize “safe heaven” assets by gaining value at the times of market corrections and financial stress.

The US dollar performance shows that its “safe heaven” characteristics are inconclusive in this period.

Conclusion

Our analysis has the similar result as papers written by Jo, Park, Shefrin and Klein, Hien, Walther.

Bitcoin is not an asset class to hold in stress. Bitcoin’s price behaves like the price of the broad stock market which is without a doubt volatile during the financial crisis. So we can’t talk about “safe-heaven” or hedging properties of Bitcoin or cryptocurrencies.

We can speculate by buying Bitcoin or other cryptocurrencies, but we must treat them as speculation. Let’s not attach them characteristics they do not have.

Authors:

Radovan Vojtko, CEO, Quantpedia.com

Dominik Cisar, Analyst, Quantpedia.com

Are you looking for strategies applicable in bear markets? Check Quantpedia’s Bear Market Strategies

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend