Capital Allocation Across a Range of Cross-Asset Alternative Risk Premia

A new financial research paper gives an ideas of how to allocate capital across several well known factor strategies:

Authors: Blin, Ielpo, Lee, Teiletche

Title: Factor Timing Revisited: Alternative Risk Premia Allocation Based on Nowcasting and Valuation Signals

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3247010

Abstract:

Alternative risk premia are encountering growing interest from investors. The vast majority of the academic literature has been focusing on describing the alternative risk premia (typically, momentum, carry and value strategies) individually. In this article, we investigate the question of allocation across a diversified range of cross-asset alternative risk premia over the period 1990-2018. For this, we design an active (macro risk-based) allocation framework that notably aims to exploit alternative risk premia’s varying behavior in different macro regimes and their valuations over time. We perform backtests of the allocation strategy in an out-of-sample setting, shedding light on the significance of both sources of information.

Notable quotations from the academic research paper:

"Alternative risk premia investing has grown rapidly in popularity in the investment community in recent years. They provide systematic exposures to risk factors and market anomalies that have frequently been widely analyzed in academic research. The vast majority of the academic literature solely focuses on the identification and the analysis of individual alternative risk premia strategies. On the contrary, this article addresses the question of allocation among alternative risk premia.

The standard approach in the industry is to apply a risk-based allocation mechanism, particularly equal risk contribution (ERC) in which one allocates the same risk budget to all components in the portfolio. One of the perceived key benefits of this approach is that it does not require expected returns as input but solely risk measures, hence the name “risk-based”. This no-views/agnostic feature alleviates the pitfalls of forecasting, which is already a challenge for traditional assets but even more so for alternative risk premia that are newer or are perceived as more complex strategies.

Despite this, recent research lends more support to the idea of some predictability of factor returns. In this article, we extend those results by focusing on the relationship between alternative risk premia and macro regimes that we define through nowcaster indicators. We consider that three major macroeconomic risks that affect risk premia: growth, inflation and market stress/volatility.

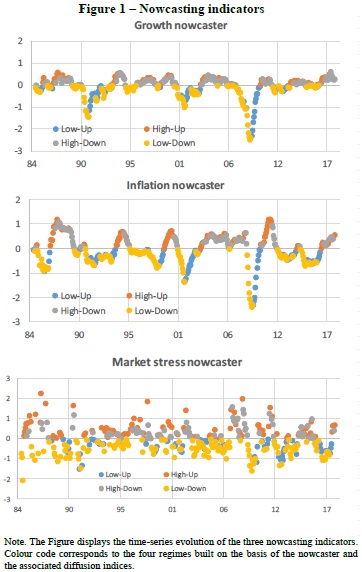

To model the influence of these macro risks, a regime approach has proven effective. To characterize macro regimes for growth, inflation and market stress, we build our own nowcasting (contraction of “now” and “forecasting”) indicators since 1990. Seeking for simplicity, our nowcasters are simple averages of z-scores of a large cross section of indicators across a large set of countries. For instance, the “growth” nowcaster contains close to 500 economic times-series across major developed and emerging countries accounting for 85% of world GDP. In Appendix A, we provide more details on the construction of the nowcasters.

To characterize economic regimes in a more precise way, we use both the average of all properly scaled economic indicators (the “nowcaster” per se) but also take advantage of the information in the cross-section by accounting for the proportion of indicators that are improving or deteriorating for every period (called “diffusion” index below). In practice, the diffusion index gives some further indication about whether the economy is improving (when diffusion index rises) or deteriorating (when diffusion index declines). On the basis of the nowcaster and diffusion indices, we define four regimes:

– Low-Up: negative nowcaster (Low) and diffusion index above 50% (Up)

– Low-Down: negative nowcaster (Low) and diffusion index below 50% (Down)

– High-Up: positive nowcaster (High) and diffusion index above 50% (Up)

– High-Down: positive nowcaster (High) and diffusion index below 50% (Down)

For the growth factor, this is similar to the usual Recession (Low-Down) / Recovery (Low-Up) / Expansion (High-Up) / Slowdown (High-Down) classification.

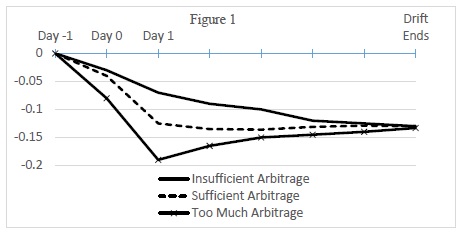

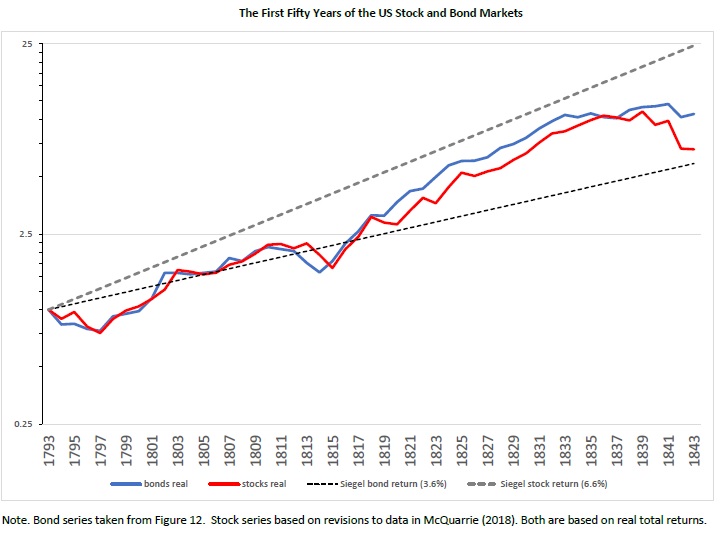

In Figure 1, we represent the different macro factor nowcasters and highlight different regimes by using a distinctive color scheme.

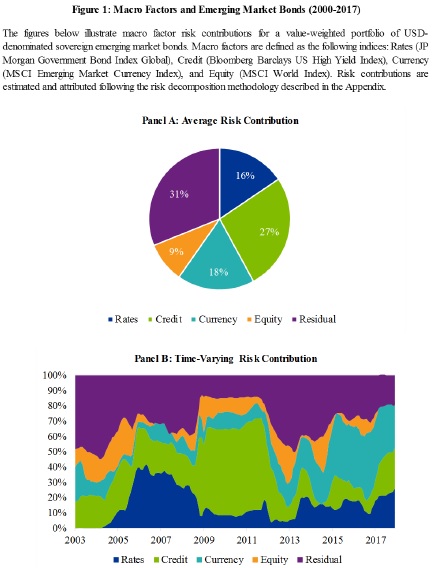

To give a first sense of the sensitivity of alternative risk premia to macroeconomic regimes, we represent in Figure 2 growth regime-conditional excess Sharpe ratios, i.e. the difference between Sharpe ratios in each growth regime and the long-term (unconditional) Sharpe ratio. Some strategies can be seen as being “defensive”, as they tend to do relatively well in either slowdowns (High-Down regime) or recessions (Low-Down regime), such as equity quality, equity low-risk, trend-following, or bonds carry. Conversely, some strategies benefits from better economic conditions such as equity size, FX carry or volatility carry.

In next section, we define and implement a process to allocate among alternative risk premia which incorporates, along other dimensions, each risk premium’s sensitivities to the macro regimes. The approach is based on the active risk-based methodology derived in Jurczenko and Teiletche (2018) which adapts Black and Litterman (1992) framework to the risk-based world. In practice, the model ends up combining a risk-based strategic portfolio with a set of dynamic allocation active views.

As our focus is on dynamic signals, we do not seek to improve the strategic portfolio. We adopt a simple ERC portfolio, which consists of equal contributions to portfolio volatility across all alternative risk premia. The strategic portfolio is then modified to incorporate dynamic deviations in two steps.

In a first step, we compute z-score reflecting dynamic allocation based on an equal-weight of two z-scores, for macro factors and valuation respectively. Regarding macro factors (growth, inflation, market stress), z-scores are computed as the excess return in the current (“nowcasted”) regime vs full sample return scaled by historical volatility.

In the second step, these dynamic z-scores are transformed into active portfolio deviations calibrated to deliver 1% tracking-error relative to the strategic portfolio. The sum of active deviations is set to zero, so that the portfolio is fully invested, similar to the strategic allocation.

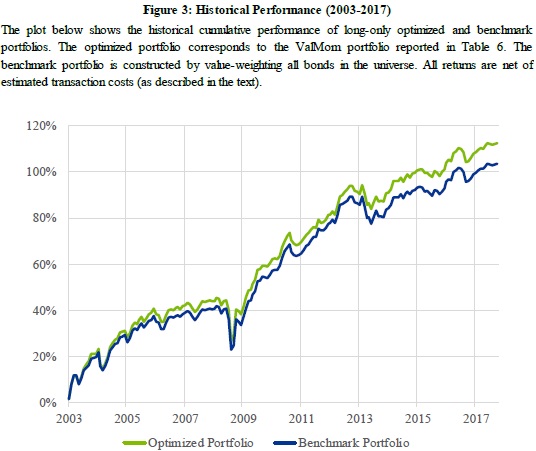

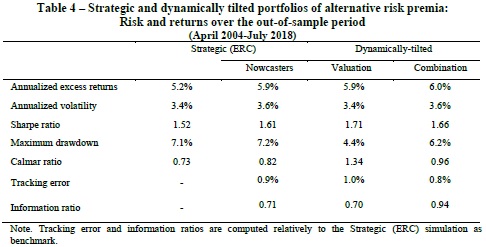

Table 4 summarizes the performance statistics of the portfolio. The first column shows the strategic ERC portfolio. The second to fourth columns show the “dynamic” portfolios that incorporate active tilts, based on nowcasters and valuation signals individually and in combination.

"

Are you looking for more strategies to read about? Check http://quantpedia.com/Screener

Do you want to see an overview of our database of trading strategies? Check https://quantpedia.com/Chart

Do you want to know how we are searching new strategies? Check https://quantpedia.com/Home/How

Do you want to know more about us? Check http://quantpedia.com/Home/About

Follow us on:

Facebook: https://www.facebook.com/quantpedia/

Twitter: https://twitter.com/quantpedia