Supercointegrated Pairs Trading

A new interesting research paper related to:

#12 – Pairs Trading with Stocks

Authors: Figuerolla-Ferretti, Serrano, Tang, Vaello-Sebastia

Title: Supercointegrated

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3005358

Abstract:

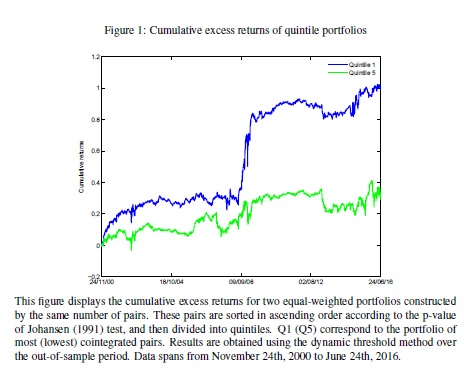

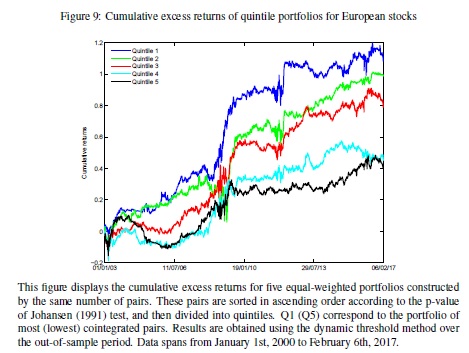

This paper uses S&P100 data to examine the performance of pairs trading portfolios that are sorted by the significance level of cointegration between their constituents. We find that portfolios that are formed with highly cointegrated pairs, named as "supercointegrated", yield the best performance reflecting a positive relationship between the level of cointegration and pairs trading profitability. The supercointegrated portfolio also shows superior out-of-sample performance to the simple buy-and-hold investments on the market portfolio in terms of Sharpe ratio. We link the time-varying risk of the pairs trading strategy to aggregated market volatility. Moreover we report a positive risk-return relationship between the strategy and market volatility, which is enhanced during the bear market. Our results remain valid when applying the strategy to European index data.

Notable quotations from the academic research paper:

"This article uses an out-of-sample analysis of S&P100 equity data to analyze performance of pairs trading portfolios when sorted by the level of cointegration of their constituents. We focus on the supercointegrated portfolio, that is formed by pairs in the top quintile of tradable targets, all of which do not reject standard cointegration tests at the 1% significance level. Indeed, the primary contribution of this article is to show that pairs trading profitability is monotonically associated with the significance level of cointegration. For the supercointegrated portfolio, the average excess return of 6.2% is earned per annum which is 2.3% higher than the portfolio with pairs in the second quintile. A similar finding is documented in terms of Sharpe ratio, which increases from 0.2 to 0.6 (yielded by the bottom and the top quintile portfolios, respectively).

A regression of the returns of the supercointegrated portfolio against the 3-factor Fama and French (1992) model shows that the market is a statistically significant explanatory variable of the pairs trading profitability. Momentum and book-to-market ratio are not significant in this exercise. We analyze the sources of risk underlying the supercointegrated portfolio and show that portfolio risk can be linked to aggregate market volatility. We then account for volatility persistence by providing maximum-likelihood estimates of an AR(1) model in the realized volatility series. We find that pairs trading profitability exhibits volatility persistence which is linked to that reported for the market. This allows us to show that lagged market realized volatility can be used to explain current pairs trading profitability. Moreover the strength of the relationship between pairs trading profitability and realized market volatility is positively associated with the level of cointegration underlying pairs trading portfolios. An extended regression analysis demonstrates that the link between realized market volatility and pairs trading profitability is enhanced under bear market conditions. This stronger connection is exclusive to the supercointegrated portfolio.

The empirical evidence provided in this article does therefore suggest that the significance level of cointegration can be used for portfolio ranking purposes. Moreover we show that this evidence is maintained under its application to European equity data. In parallel to our findings, this article conducts several exercises to assess the robustness of its main results. The additional checks conclude, once again, the strength of the supercointegrated portfolio.

."

Are you looking for more strategies to read about? Check http://quantpedia.com/Screener

Do you want to see performance of trading systems we described? Check http://quantpedia.com/Chart/Performance

Do you want to know more about us? Check http://quantpedia.com/Home/About