What is the Capacity of Smart Beta Strategies ?

An academic paper related to multiple smart beta strategies:

Authors: Ratcliffe, Miranda, Ang

Title: Capacity of Smart Beta Strategies: A Transaction Cost Perspective

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2861324

Abstract:

Using a transaction cost model, and an assumption for the smart beta premium observed in data, we estimate the capacity of momentum, quality, value, size, minimum volatility, and a multi-factor combination of the first four strategies. Flows into these factor strategies incur transaction costs. For a given trading horizon, we can find the fund size where the associated transaction costs negate the smart beta premium, assuming current rebalancing trends and holding constant other market structure characteristics. With a trading horizon of one day, we find that momentum is the strategy with the smallest assets under management (AUM) capacity of $65 billion, and size is the largest with an AUM capacity of $5 trillion. Extending the trading horizon to five days increases capacity in momentum and size to $320 billion and over $10 trillion, respectively.

Notable quotations from the academic research paper:

"We study the capacity, in terms of AUM, of smart beta strategies—momentum, quality, size, value, and minimum volatility. We also study a strategy combining the first four of these factors. All of these smart beta strategies can be implemented with transparent, third-party indices and directly traded as ETFs. The strategies are also long only.

We base our analysis on a transaction cost model developed by BlackRock, Inc. that is used on a daily basis by different investment teams. In line with a sizeable microstructure literature building on Glosten and Harris (1988) and Hasbrouck (1991), the transaction cost model includes both fixed-cost and non-linear market impact components. The parameters of the model are updated on a daily basis, based on trading executed by BlackRock across all of its portfolios. For example, BlackRock traded over $340 billion in US equities during January to March 2016, an indication of the amount of data that is used to calibrate the model. Thus, the transaction cost model gives an estimation that a large asset manager would face in executing trades in ETF securities.

We define capacity as the breakeven hypothetical AUM at which the associated turnover transaction costs exactly offsets the historically observed style premium.6 Since this calculation is sensitive to the assumption of the magnitude of the premium, we present results varying the premiums. A key variable that determines smart beta capacity is the turnover of the factor, and we assume recent rebalancing trends are a good representation of the expected turnover going forward.

The exercise we conduct in this paper is hypothetical and involves several unrealistic assumptions. We assume that all trading takes place in a given interval—over one day, and over a longer horizon of five days. We assume that market structure characteristics of the factor vehicles, like turnover (measured as two-way, annualized), and of the market itself, like no entry and exit of stocks in these strategies, are held fixed as the flows come in. We gauge capacity only by transaction costs incurred by inflows, and so ignore the funding costs of those flows (which could come from other stocks or asset classes). We are not saying the transaction cost estimates are definitive measures of capacity of smart beta strategies—but they are informative in that they measure an important real-world trading friction that reduces returns earned by investors.

As expected, the strategy with the smallest capacity is momentum—the style factor with the highest turnover. Momentum has an estimated breakeven AUM of $65 billion. If trading occurs over one day, we find that the breakeven AUM for size is the largest, at approximately $5 trillion, followed by minimum volatility, which is above $1 trillion. However, if trading is allowed to occur over five days, which is common for larger trades, instead of over one day, the capacity of momentum increases from $65 billion to $324 billion. Finally, the combination of value, size, momentum, and quality factors has an estimated breakeven AUM of $316 billion and $1.5 trillion over trading horizons of one and five days, respectively. In reality, it is likely that many aspects of the markets—including the composition of the stocks in the factor strategies themselves—will change before flows of this magnitude are realized. What is important is the large size of these numbers, rather than the absolute numbers themselves, which indicate that transaction costs have to be very large in order to have a significant effect in reducing returns to investors in smart beta strategies. Put another way, capacity considerations in smart beta are likely to come from economic sources other than trading costs."

Are you looking for more strategies to read about? Check http://quantpedia.com/Screener

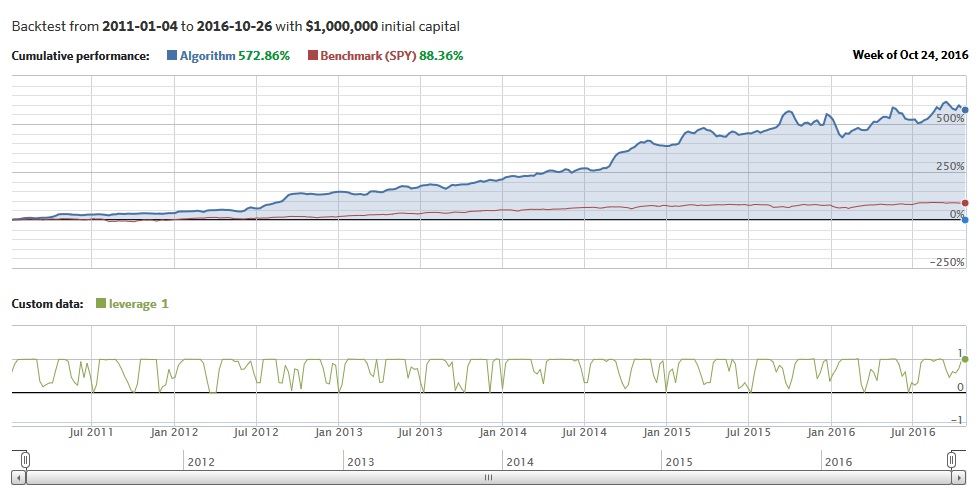

Do you want to see performance of trading systems we described? Check http://quantpedia.com/Chart/Performance

Do you want to know more about us? Check http://quantpedia.com/Home/About