FOMC Equity Drift Occurs in Periods of High Uncertainty

A new research paper related mainly to:

#75 – Federal Open Market Committee Meeting Effect in Stocks

Authors: Martello, Ribeiro

Title: Pre-FOMC Announcement Relief

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3286745

Abstract:

We show that the pre-FOMC announcement drift in equity returns occurs mostly in periods of high market uncertainty or risk premium. Specifically, this abnormal return is explained by a significant reduction in the risk premium (implied volatility and variance risk premium) prior to the announcement, but only when the risk premium is high, e.g., when it is above its median. Likewise, the magnitude of the FOMC Cycle and other related patterns varies with uncertainty and risk premium. Market uncertainty measures are persistent and are not related to policy uncertainty or expectations. Markets become only marginally stressed in the days prior to the announcement and changes in uncertainty appear to be of lower frequency. We also explain why recent studies suggest that the pre-FOMC drift might have disappeared in the past decade, as this moderation is due to time variation that was also present in older data. Additionally, CAPM only works on FOMC dates when the risk premium is high, e.g., implied vol above its prior median level. The results are robust to different samples and measures of risk premium and uncertainty.

Notable quotations from the academic research paper:

"We show that pre-announcement return drift is associated with significant declines in risk (premium) during times of high risk (premium). Implied volatility and the variance risk premium decrease in the hours before the announcement in an almost perfect mirror image of the increase in market prices. Moreover, we show that the magnitude of the return drift and the decline in risk depends on the level of market implied volatility, or other related variables, days or even weeks prior to the announcement.

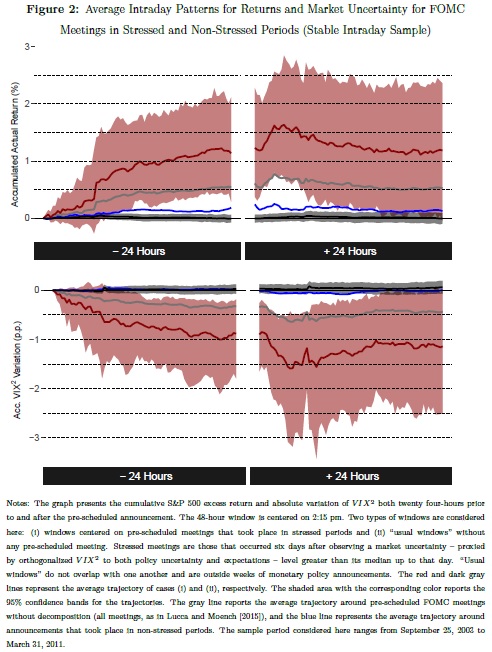

Just to exemplify, the average pre-FOMC drift when implied volatility is above its prior median is 109 basis points (bps), while it is only 9.7 bps when it is below its median. In the bottom 20% of implied volatilities, the drift is close to zero or even negative, depending on the specification. Lucca and Moench [2015] also showed the importance of the VIX in their analysis, but here we show that this and other market uncertainty variables are actually essential for a better understanding of the pre-announcement return drift and all FOMC announcement related patterns. Figure 2 replicates a figure in Lucca and Moench [2015] that shows stock market performance around FOMC releases. Here we show that the pre-announcement drift is much stronger in periods of high risk premium and uncertainty.

We also provide clear evidence of investor relief, i.e., a decline in implied volatility or other risk measures, hours before the announcement using intraday information. Panel B of Figure 2 also shows that uncertainty is going down as a mirror image of the realized return. The magnitude of this pre-announcement investor relief also depends on the level of market uncertainty, as it tends to go down more when it is high. Considering the squared value of the VIX as our priced risk proxy, we show that, during high volatility periods, implied variance declines by 103.5 bps in anticipation of the announcement, while during low volatility periods, it rises by insignificant 0.3 bps. Hence, high volatility periods present both higher realized equity returns and greater resolution of market uncertainty hours before pre-scheduled announcements.

"

"

Are you looking for more strategies to read about? Check http://quantpedia.com/Screener

Do you want to see an overview of our database of trading strategies? Check https://quantpedia.com/Chart

Do you want to know how we are searching new strategies? Check https://quantpedia.com/Home/How

Do you want to know more about us? Check http://quantpedia.com/Home/About

Follow us on:

Facebook: https://www.facebook.com/quantpedia/

Twitter: https://twitter.com/quantpedia

"

"

"

"