This blog post is the continuation of series about Quantconnect’s Alpha market strategies. Part 1 can be found here. This part is related to the factor strategies notoriously known from the majority of asset classes. Although the results are insightful, they are not straightforward, and further analysis could be made. Therefore, stay tuned for the next parts!

Introduction

We have already established that we can construct an investable benchmark, but can we beat it? Are there any characteristics that can be used to sort alpha strategies to gain the edge?

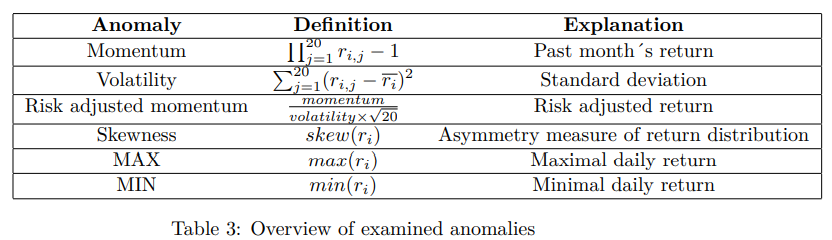

Each asset class is connected with numerous anomalies, and some are so common that they are recognized as factors (e.g. carry in currencies, basis in commodity futures, momentum everywhere, etc.) In our case, the finding of factors can be problematic. The strategies are multi-asset, and the only available information is the past return series.

Still, there are numerous anomalies across various asset classes that only utilize the past prices/returns. Therefore, we examine several anomalies which were previously identified to predict future returns across many asset classes. Therefore, even though the original reason for the functionality might not apply to the systematic strategies, the tests can reveal any properties suitable for a trading strategy.

Momentum Anomaly

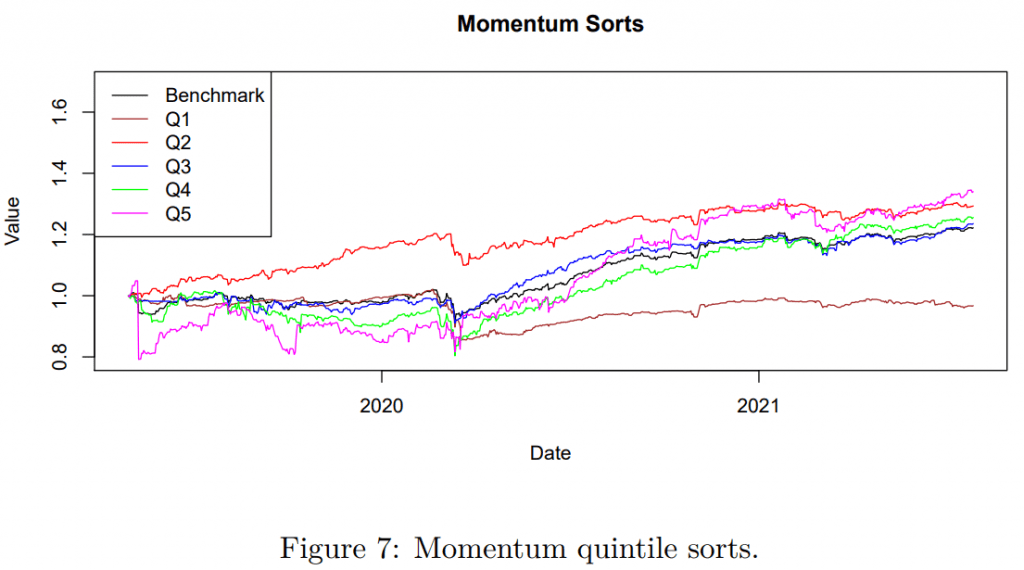

Momentum is a premier anomaly found in individual stocks (Jegadeesh and Titman (1993)), currencies (Menkhoff et al. (2011)), commodities (Miffre and Rallis (2005)), short-term momentum in bonds (Zaremba et al. (2019)), but also in the equity factors (Arnott et al. (2020)). For our case, the most promising results are those of Huang and Huang (2020), because the research has identified momentum in published anomalies/trading systems. Based on the simple idea that past outperformers tend to continue doing so and past losers tend to underperform, we can expect that the momentum effect could also be found in the alpha strategies. Thus, the possible return could stem from either the momentum in individual assets/factors or by the performance continuation of the outperforming strategies. Throughout the paper, we examine the short-term 20 days momentum.

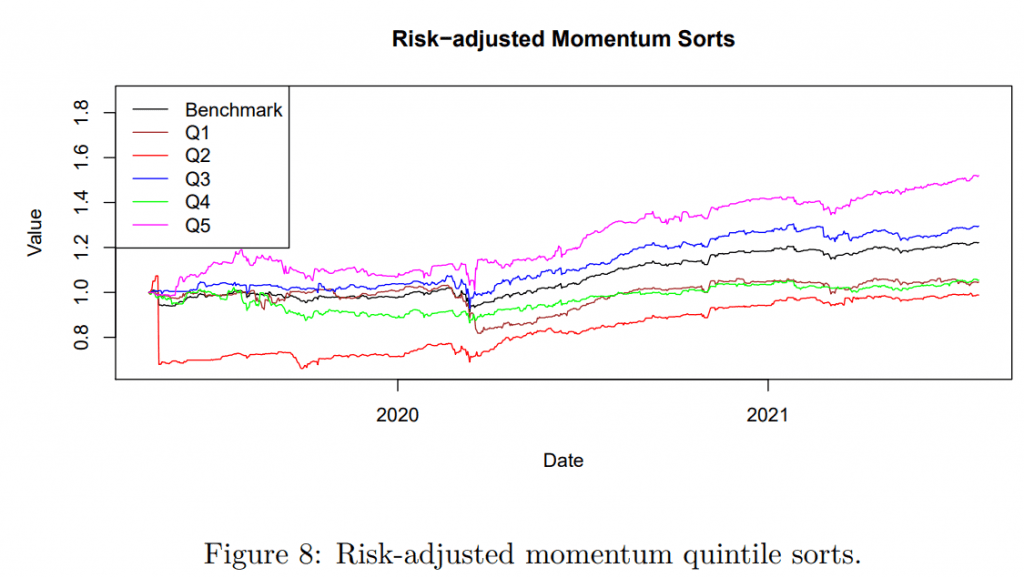

Although the momentum is widespread and deemed to be highly profitable, it suffers from momentum crashes. Numerous approaches were suggested to fix these crashes, where one of them is the risk-adjusted momentum since the crashes are frequently caused by the most volatile stocks. Fan et al. (2020) suggest generalized risk-adjusted momentum in stocks, commodities, global equity indexes, and fixed income markets, where the past return is divided by the realized volatility raised to the power of 0 to 4. We examine a simple version of the risk-adjusted version: the past return is divided by the volatility not raised to any power. Practically, this leads to a sort based on the Sharpe ratio.

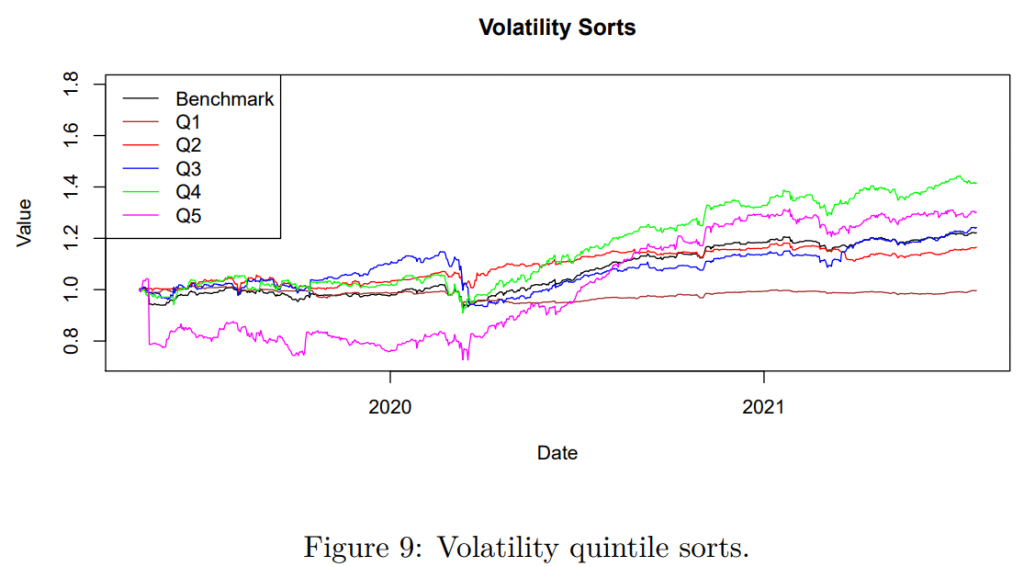

Volatile assets tend to be problematic in the momentum strategies, but apart from momentum, the theory suggest that the investors should be rewarded by bearing higher risk. Despite the theory, Blitz and van Vliet (2007) found that stocks with lower volatility outperform the stocks with higher volatility. Nevertheless, investors are rewarded in cryptocurrencies by bearing the higher risk, and more volatile cryptos outperform the low volatile cryptos, as shown by Han et al. (2021).

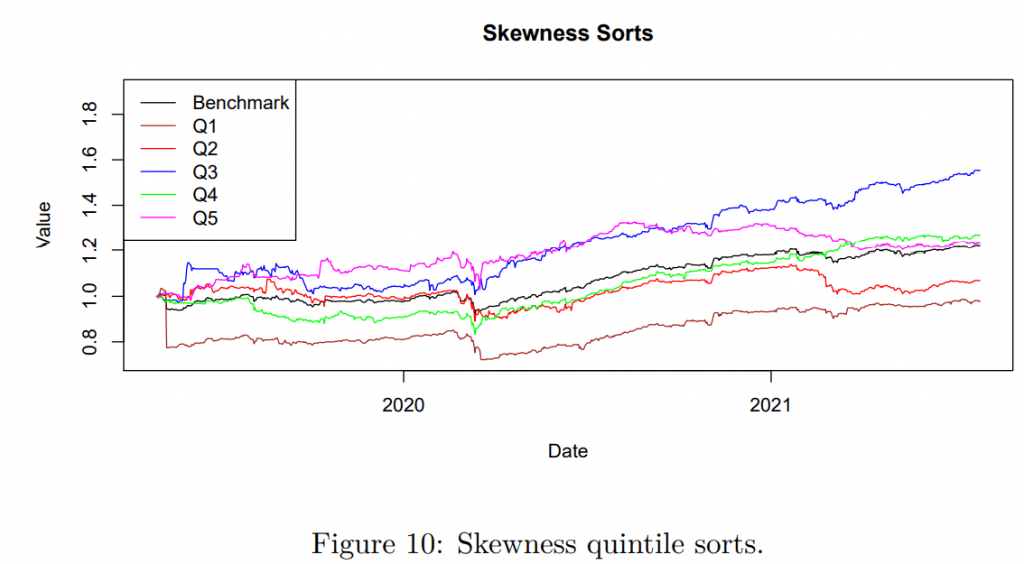

Skewness Effect

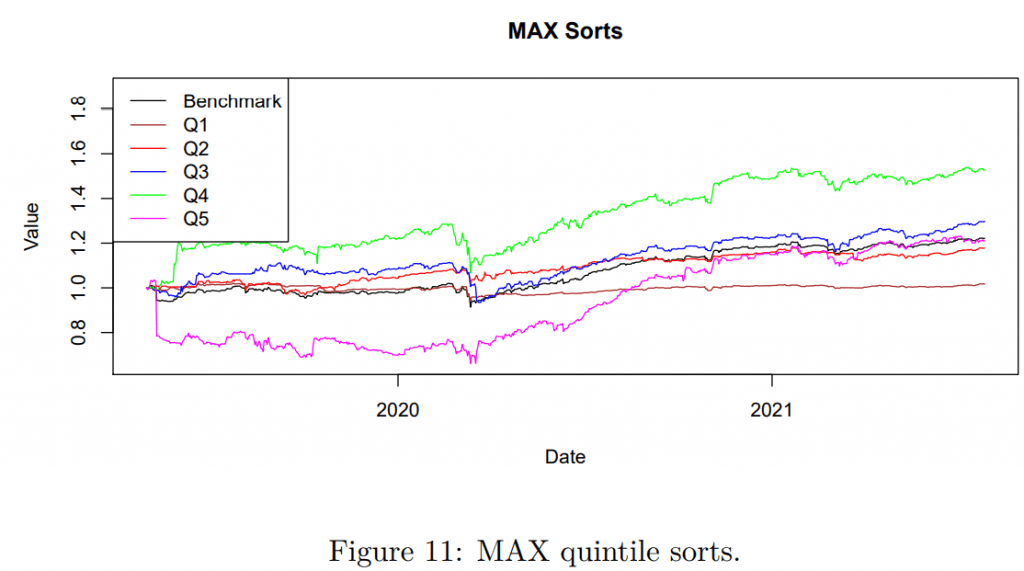

Another widespread anomaly is the skewness effect. Fernandez-Perez et al. (2015) found the skewness effect in commodities, showing investors prefer assets with possibly high returns (that are not very probable) even though they pay a higher price and earn lower subsequent returns. The skewness effect was also found in country indexes (Zaremba and Nowak (2015)). The skewness is closely related to the lottery effect in stocks, where the maximal past return is utilized (Bali et al. (2005)). Therefore we examine both the skewness of realized returns and max past daily return (MAX effect).

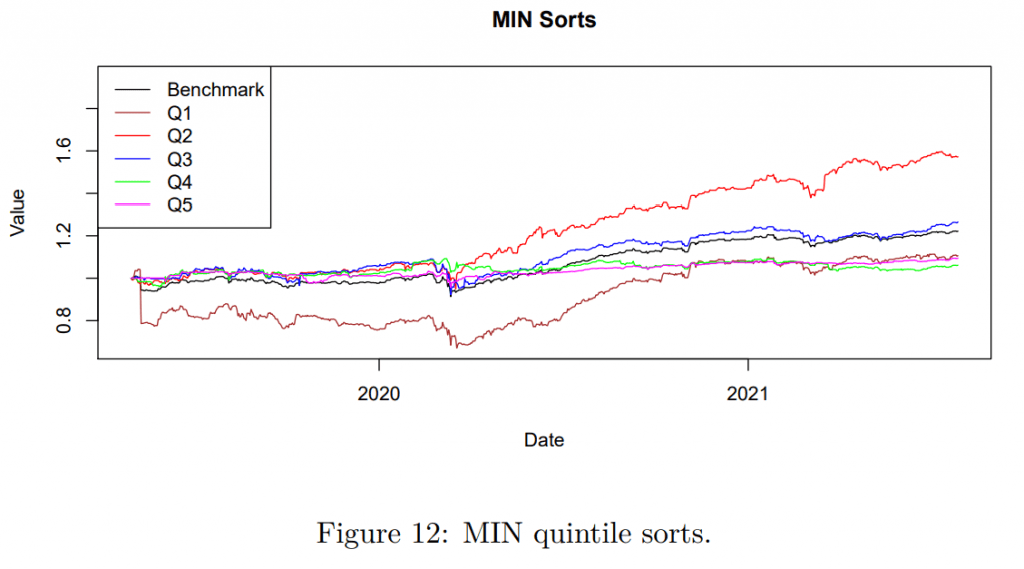

On the contrary to the MAX effect, DeLisle et al. (2020) examined the MIN effect. Authors describe stocks with the lowest daily returns as “hazard” stocks, the opposite of lottery stocks. Although the investors should discount the hazard stocks, the negative returns persist due to the underreaction.

Factor sorts

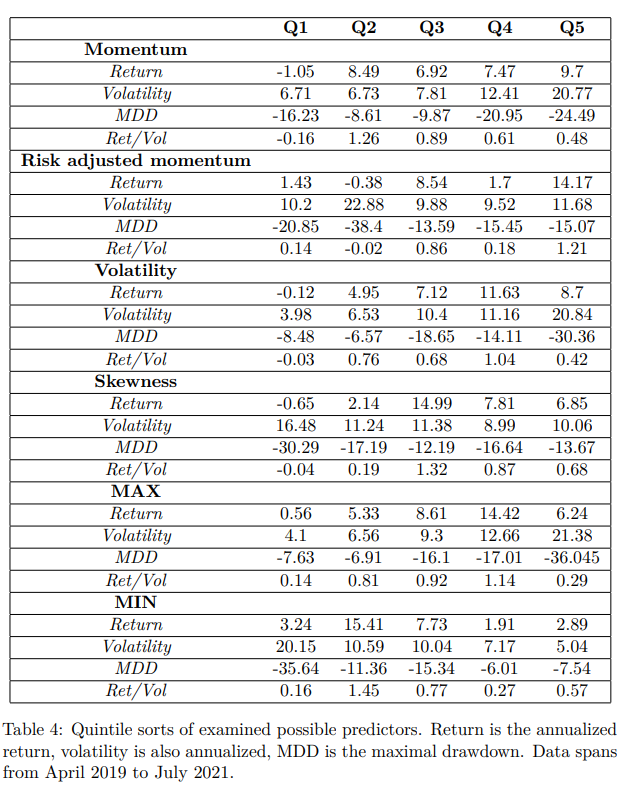

As we have previously mentioned, there is no guarantee that the theory would also hold for the quantitative alpha strategies. On the other hand, even though some effects were originally found in one asset class, researchers have found that it has the opposite effect in a different class. For example, while the past one month return is connected with the reversal in stocks, it is a short-term momentum signal in bonds. Likewise, the low volatility effect works in stocks but does not work in cryptos. Therefore, it is the foremost task to examine the well-known effects also in the alpha strategies. All the anomalies mentioned above are examined through portfolio sorts using twenty past daily returns (denoted as ri for i-th strategy) with a rebalancing period of twenty days. Every 20 days, anomalies are ranked based on each anomaly and sorted into quintiles. Positions are equally weighted.

Interestingly, apart from the risk-adjusted momentum sorts, extreme values are connected with undesirable results. The highest momentum quintile is the most profitable but suffers from large drawdowns and volatility. In the case of momentum, it seems that this could be easily solved by the risk-adjusted momentum since thus sort is among the most profitable on a risk-adjusted basis.

The returns rise across quintiles for volatility sorts, but the extreme fifth quintile is somewhat too extreme. Similar effects could be observed in MIN and MAX sorts. For MAX, the returns rise with the prior maximal daily return, and there seems to be continuation and lottery theory does not seem to hold – the anomalies are not “overpriced”. However, the most extreme quintile with the highest past daily return seems to be extreme too much, similar to the volatility sort.

For the MIN effect, there seems to be a reversal, in line with the expectation of the literature if the MIN anomaly would not exist. Nevertheless, the most extreme values of minimal daily return are connected with underperformance.

Overall, the results suggest that the most extreme returns – either too volatile, too high or too low predict underperformance, but moving a quintile right (left) tend to strongly predict future’s performance. Therefore, it seems that past outlier strategies would be best to omit. This finding could also be supported by the skewness sorts, the most profitable skewness quintile the neutral “middle” one. Skewness portfolios show that the right tail is more profitable than the left tail, but the extreme values are still less profitable than the neutral skewness. Therefore, the results strongly point to reducing the set of strategies, removing the “outliers”.

Short Conclusion

There are several well-known factor strategies in asset classes. Some of them contradict the economic theory and hence are labelled as anomalies. For example, investors are not rewarded by bearing riskier stocks because they overpay them. Among the alpha strategies, we can frequently see the opposite, as the literature has identified. Strategies tend to be compensated for higher risk, strategies with the highest past daily return tend to outperform, and a reversal is connected with the lowest past daily return. However, the most extreme quintiles based on volatility, MIN or MAX returns, suffer from large drawdowns and volatility but also have low returns. Skewness sorts also support this theory. Strategies with the most “neutral” distributions have the second-best risk-adjusted return and reasonable maximal drawdown.

On the contrary to the metrics that mostly characterize statistical distributions, the momentum anomaly is largely in line with the vast literature. There is a return continuation, but also, as in the majority of markets, the momentum can be too risky, and the risk-adjusted momentum works better. Overall, the factors on alpha strategies provide insightful results that could be utilized. The results particularly point to excluding the most extreme strategies based on various past distribution’s characteristics.

Stay tuned for the 3rd and 4th part of this series, where we will explore factor meta-strategies built on top of the QuantConnect’s Alpha Market. Part 1 is already available here.

Author:

Matus Padysak, Senior Quant Analyst, Quantpedia

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend