First-Half Month Cash-Flow News and Momentum in Stocks

Stock prices react to the new information that investors continually receive from many sources. There are some major events, which are commonly connected with a new piece of information and subsequent reactions of investors. For example, quarterly earnings-announcements are the cause of the post-earnings announcement drift or PEAD. According to the PEAD, prices tend to continue to drift up (down) after positive (negative) news. But news related to quarterly announcements is not the only important information. A novel research paper written by the Hong and Yu explores implications of the month-end reporting, analyst revisions and management guidance that are coming to market usually in the first half of each month and are also connected with drifts that offer practitioners profitable opportunities.

Authors: Claire Yurong Hong and Jialin Yu

Title: Month-End Reporting, Cash-Flow News, and Asset Pricing

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3685595

Abstract:

We show that the stock market regularly and systematically receives information about company fundamentals through month-end reporting, even before the quarterly earnings announcement. Such cash-flow news concentrates at the beginning of a month and affects company announcements, analyst revisions, and stock returns. Using this time variation in cash-flow news, we show evidence supporting cash-flow news being more persistent than discount-rate news. Individual stock returns exhibit a post-monthly-announcement drift. Time series market momentum exists only when conditioning on past first-half month return, and is stronger when the past market-wide earnings surprise is bigger.

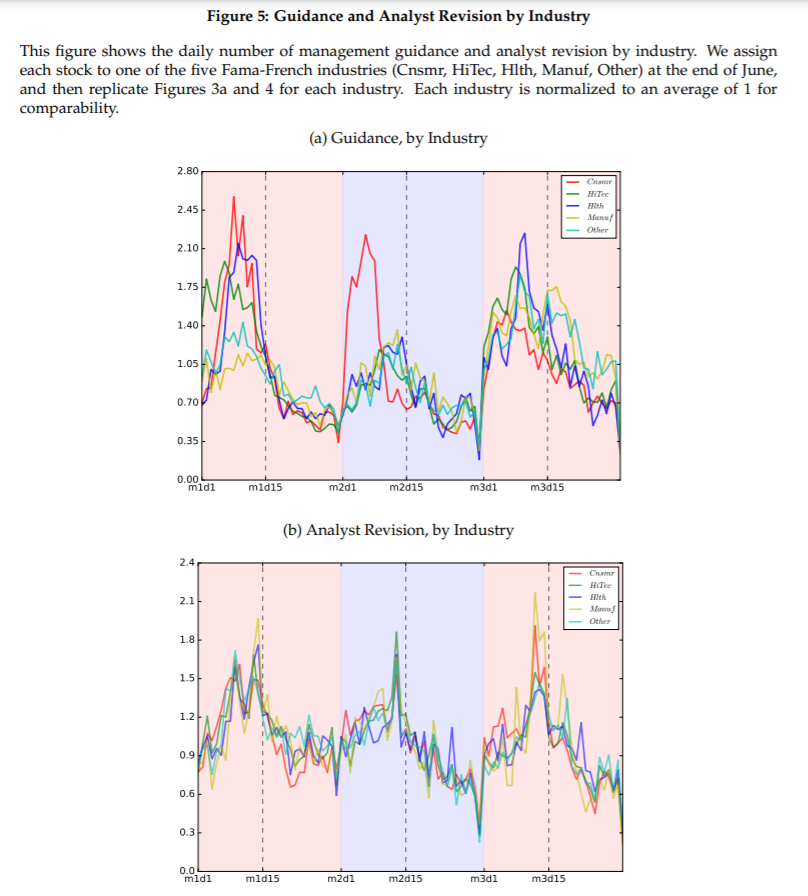

The new piece of information (management guidance) or analyst revisions becomes obvious from the following graphs. “mxdy” in the horizontal axis denotes day y of month x in a quarter. E.g., m1d15 means day 15 in January, April, July, and October.

Notable quotations from the academic research paper:

“In addition to quarterly earnings and analyst revision, the monthly announcement also affects the contemporaneous return dynamics of the announcing firms. Those stocks with high monthly announcement CAR have disproportionately higher returns in the first half (H1) than the second half (H2) of the month because the monthly announcements are concentrated in the first half of a month. Surprisingly, the effect remains when we sort by the monthly return instead of the announcement CAR. I.e., when we sort stocks based on their whole-month returns, we find that stocks with high returns in a month have disproportionately higher returns in H1 than H2 of the same month. This is surprising because H1 and H2 are ex-ante symmetric components of the whole-month return.

Further, the effect is substantial. When sorting stocks into quintiles based on their whole-month returns, the H1 and H2 return difference in the same month is 0.19% per day higher for the top quintile than the bottom quintile, or equivalently 47.88% annualized. The difference between H1 and H2 disappears when we exclude the three-day monthly announcement CAR from the analysis. This shows that the cash-flow news revealed by the monthly announcements is sufficiently large and tilted towards the beginning of a month that it affects the contemporaneous return dynamics within a month. To our knowledge, we are the first to point out this large return dynamics in a month—high (or low) monthly return is disproportionately realized at the beginning of the same month—and we provide evidence that the monthly announcements drive such dynamics.

The monthly announcements exhibit a post-announcement return drift. This resembles the quarterly post-earnings-announcement drift (PEAD) in Ball and Brown (1968) and Chan et al. (1996), where stock returns continue to drift up for “good news” firms and down for “bad news” firms.

We rank stocks at the middle of a month by their monthly announcement CAR during the first half of a month and find a positive return drift in the second half of the month.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend