Pre-Announcement Returns

Earnings announcement days are really important dates in a usual yearly corporate routine. The stock market usually reacts sharply on earnings announcement news and stocks on average earn statistically significant return excess of the market over the short window centred around the announcements. But how does the movement of stocks look before earnings announcement? The recent research paper written by Gao, Hu, and Zhang analyzes price action before and after earnings announcement and shows that a majority of the announcement month premium is realized during the pre-announcement period. Stocks with higher levels of uncertainty (stocks are sorted based on their option implied volatilities) experience larger pre-announcement returns and more uncertainty resolution during the pre-announcement period …

Authors: Gao, Chao and Hu, Grace Xing and Zhang, Xiaoyan.

Title: Uncertainty Resolution Before Earnings Announcements

Link: https://ssrn.com/abstract=3595953

Abstract:

We show that 71% of the earnings announcement premium takes place before, rather than after, earning releases. We attribute this pattern to uncertainty resolution before earnings announcement, and provide compelling evidence that high uncertainty stocks experience more uncertainty resolution and therefore have larger pre-announcement return before earnings releases. This effect is stronger when the aggregate market uncertainty is high and when earnings announcements carry more systematic uncertainty. Both the systematic and idiosyncratic components of a firm’s uncertainty can predict its pre-announcement return. Uncertainty resolution could happen via two distinct channels: information acquisition by investors and information supply by analysts.

Notable quotations from the academic research paper:

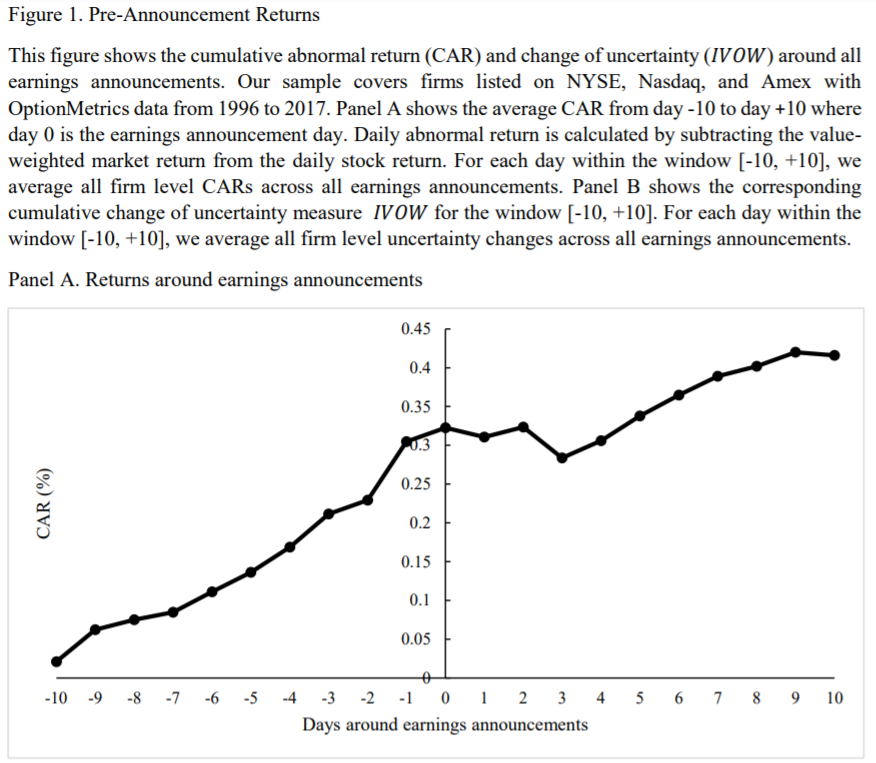

“During our sample period, stocks on average earn 0.42% in excess of the market over a 21-day window centered on earnings announcement dates. Surprisingly, a majority of the announcement month premium is realized during the pre-announcement period, that is, before earnings announcements are released. The average excess return during a 10-day pre-announcement window is 0.31%, accounting for 71% of the total earnings announcement premium.

We argue that earnings news carries two distinct risks: the one on the news itself and the one on the uncertainty associated with the news. Both risks carry their own risk premium. The resolution of these two risks, however, could happen at different times. Over an accumulation period before earnings announcements, the anticipation of upcoming announcements naturally brings heightened uncertainty to the underlying stock.

As earnings announcement day approaching, this heightened uncertainty starts to get resolved and the corresponding risk premium is realized during a short-time window before announcements. Stock prices respond to the resolution of the uncertainty risk, yielding a positive pre-announcement return. At the actual announcement day when the earnings are released, the news risk itself is fully resolved and stock prices respond accordingly.

We find that stocks with higher levels of uncertainty experience larger preannouncement returns and more uncertainty resolution during the pre-announcement period. When we sort stocks based on their option implied volatilities measured at 11 days before announcements, high uncertainty stocks have an average 1.52% market-adjusted abnormal return and an average 1.8% drop in their uncertainty during the next 10-day trading window before announcements, and both numbers are highly significant. In contrast, low uncertainty stocks do not experience significant pre-announcement returns and their uncertainty actually increases by 5.1% before earnings announcements.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend