Backtesting ESG Factor Investing Strategies

Socially Responsible Investing (also called ESG Factor Investing) grows in popularity. More and more investors enter the stock market not just to invest their savings, but they are also want to support companies that bring positive social or environmental change. ESG factor investing can bring satisfaction to those investors. But does it also brings a real outperformance in a financial sense? Is there some ESG factor alpha? How big is it? These are some of the questions we have decided to investigate – we obtained data, identified ESG factor strategies and tested them. Feel free to explore them with us…

Introduction to ESG

A reader who knows what the ESG investing is can skip this part and go directly to backtesting, as we will shortly explore few ESG basics in the next few paragraphs.

How can we measure if any company is responsible to the environment and overall society? Simply, by grading it – the ESG score measures the firm’s quality in three categories: environmental, social and governance. Each category is affected by different things. The environmental score takes into account carbon emissions, low resource consumption, pollution, innovations aiming to improve environmental protection and much more. Social score focuses on human rights, business ethics, safety standards for workers, cash donations, protection of public health and so on. Factors that affect the governance score can be rights of shareholders or the company’s financial and non-financial goals.

The question of why would someone use ESG score as an indicator has multiple answers. Firstly, there might be a non-financial motivation, for example, a religious belief. Certain religions may want to exclude sectors like the gambling, alcohol or armament industry from their portfolio. Secondly, the philanthropic point of view that seeks green, socially responsible investments is gaining popularity in recent years. High ESG score is seen as appealing for those investors. And lastly, high ESG score can signal forward-thinking and efficient company, and those attributes can signal better financial performance.

Of course, there are a lot of research papers which are focused on the applicable ESG investing strategies; they examine if using ESG score enhances, harms or has no effect on the performance. If researchers confirmed the performance-enhancement, it would mean that ESG scores could be utilized as factors, and used in practice. Also, if there was no correlation between ESG score and performance, an investor, who seeks sustainable investing could be interested in it (as his performance would not be penalized). On the other hand, the focus on the ESG scores could lead to investing in unprofitable companies or reduce an investment universe in a way that wouldn’t be diversified.

The separate problem with ESG score is that it’s hard to measure it objectively. There are multiple data providers with huge databases, but each provider can value different elements of a company on an individual scale. Also, data providers can weight the three scores differently. The result is that the score of one company can widely vary between data providers.

Backtesting setup

Does ESG scoring add any incremental information? Can we build equity factor strategies based on it? We decided to test it for ourselves.

We went to look for the ESG data provider and obtained an unfiltered ESG data from OWL Analytics.

The data set we worked with contained monthly data from March 2009 to October 2019; for each month, we had from 5000 (at the beginning of the sample) up to almost 30 000 companies to work with. For each company, we got its ISIN, shareClassFIGI, region, and over 200 detailed parameters for the E, S, and G score and of course, the total ESG score.

Because we wanted to focus on the U.S. market, we filtered companies from that region, and through their ISIN, we paired them with their ticker and price for each month. Then we deleted small firms and those to which we did not get the ticker or price from our data set. In the end, we were left with around 700 companies.

Both strategies were backtested using QuantConnect framework.

ESG Factor Momentum Strategy

The first strategy we decided to test was the ESG Factor Momentum Strategy. This strategy is based on overweighting companies, whose ESG score increased in the recent past and underweighting companies, whose ESG score decreased. The increases and decreases are based on a 12-month ESG momentum, and the strategy is usually rebalanced monthly.

There are multiple methodologies of how factor strategies can be built. We decided to follow the standard approach of building equity long-short factor strategies – sorting into deciles and going long the best and going short the worst decile.

Our implementation of momentum is as follows; we took our finalized data, and we analyzed the percentage shift in ESG scores in the last twelve months. We took into an account the two-month delay in the data. Then we divided the scores into deciles; we go long on the 10% of the stocks with the greatest ESG momentum and short on the 10% of the stocks with the lowest ESG momentum. The portfolio was value-weighted, so the higher the market capitalization the stock had, the greater weight we gave it. That solved the problem of small stocks having a great impact on the performance of our portfolio. The holding period was three months, unlike the one month that is usual for this strategy. Because of the two-month delay (skip period), we wanted some time for the momentum to manifest; therefore one month holding period after two month skip period seemed too short to us, and we picked three months instead. We also implemented tranching – each month, we rebalanced 1/3 of the portfolio, so in three months, the whole portfolio is rebalanced.

ESG Level Factor Strategy

The second strategy we tested was the ESG Level Factor Investing Strategy. This strategy, like the ESG Factor Momentum Strategy, is value-weighted but is rebalanced on a yearly basis.

Our implementation of this strategy is as follows: Firstly we divided the data into quintiles, we went long on the top 20% of the stocks with the greatest aggregate ESG level and short on the 20% of the stocks with the lowest aggregate ESG level. We decided to use the aggregate ESG score for our strategy to keep things simple. But data from OWL Analytics offers more detailed scores for each of the environmental, social and governance scores. Therefore a more sophisticated strategy built from multiple sub-strategies based on each of the E, S and G sub-scores can be probably built.

We decided to hold stocks for 12 months. The reason for this is that ESG level is similar to value or other fundamental factors, which take longer to manifest the information to the price, unlike the ESG momentum which is closely related to other momentum-based factors. Because of the long holding period, we had to divide the portfolio into twelve parts, and each month we rebalanced 1/12 of the portfolio, so the entire portfolio was rebalanced in one year.

Conclusion

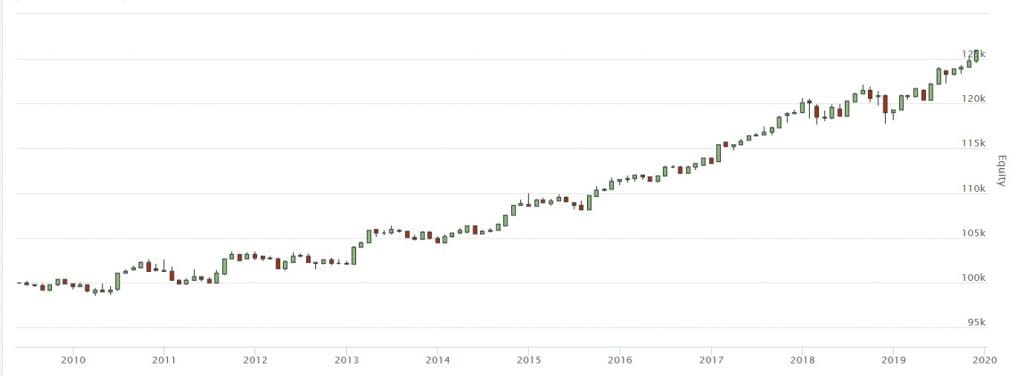

After we tested both of these strategies on our data, we can conclude that factor strategies based on ESG scoring seem profitable during the last several years. Our findings confirm the broader trend of recent outperformance of strategies based on ESG (see multiple articles like this, this or this).

What surprised us is that the ESG level had better performance than the ESG momentum. Performance of the momentum was positive, although low even after the ten year period. However, ESG level performed unexpectedly well. ESG scoring seems to be applicable to use in the portfolio as an addition to other better-known factors (like value, momentum, low-volatility, etc.); however, we still recommend caution. Because of the fact that the ESG data are not consistent among data providers, the reproduction of a certain approach may lead to different results if the same dataset is not used. A possible solution is to work with as many ESG datasets as possible. But we hope that we have presented the glimpse into the possible application of ESG scores from the quantitative point of view. Either for profit-enhancing properties or producing more socially responsible strategies.

Authors:

Radovan Vojtko, CEO & Head of Research, Quantpedia

Daniela Hanicova, Quant Analyst, Quantpedia

Filip Kalus, Quant Analyst, Quantpedia

Are you looking for more providers of alternative data? Check our Alternative Data section

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Are you looking for historical data or backtesting platforms? Check our list of Algo Trading Discounts.

Would you like free access to our services? Then, open an account with Lightspeed and enjoy one year of Quantpedia Premium at no cost.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookRefer to a friend