The Theory of Portfolio Management sub-page presents a selected list of Quantpedia’s research articles related to essential portfolio management topics like factor analysis, theory of asset allocation, risk management and position sizing.

An Introduction to Volatility Targeting

One of the most popular reports in the Portfolio Analysis section of our Quantpedia Pro tool is “Volatility Targeting”. In this article, we will explain some theory behind this portfolio management method. And then, we will go more in-depth, pick several examples and explain some common volatility targeting variants.

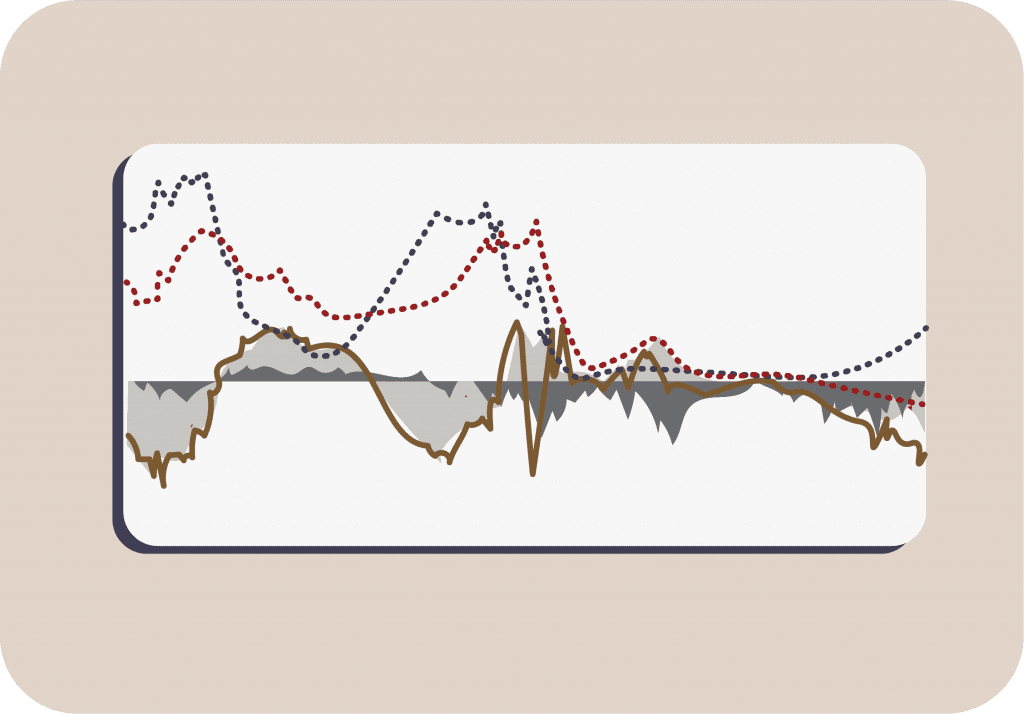

A Robust Approach to Multi-Factor Regression Analysis

This blog post aims to introduce the multi-factor regression model we use in the Quantpedia Pro tool, its logic and the method we have decided to use.

Continuous Futures Contracts Methodology for Backtesting

The industry standard for backtesting futures strategies is to construct one data sequence from a stream of contracts. Our short article shows the importance of choosing the correct methodology for building continuous futures contracts data series…

How Do Investment Strategies Perform After Publication?

In this article, we will look deeper on whether the market anomalies can be arbitraged away, if the profits are lower for the specific strategy once the strategy becomes well-known, and even if the strategies can be timed. Quantpedia‘s readers are often interested in these common topics, and we will try to shed some light on them.

The Knapsack problem implementation in R

Our own research paper ESG Scores and Price Momentum Are More Than Compatible utilized the Knapsack problem to make the ESG strategies more profitable or Momentum strategies significantly less risky. The implementation of the Knapsack problem was created in R, using slightly modified Simulated annealing optimization algorithm. Recently, we have been asked about our implementation and the code.

Risk Parity Asset Allocation

This article is a primer into the methodology we use for the Portfolio Risk Parity report, which is a part of our Quantpedia Pro offering. We explain three risk parity methodologies – Naive Risk Parity (inverse volatility weighted), Equal Risk Contribution and Maximum Diversification.

Markowitz Model

This report helps calculate the efficient frontier portfolios based on the various constraints and during different predefined historical periods. Furthermore, it aims to create the most return-to-risk efficient portfolio by analyzing various portfolio combinations based on expected returns (mean) and standard deviations (variance) of the assets.

Introduction to CPPI methodology

Constant Proportion Portfolio Insurance (CPPI) is a strategy that enables an investor to keep exposure to a risky asset’s upside potential while providing a guarantee against the downside risk by dynamically scaling the direction. It’s a popular strategy often used to build protected funds or as a part of various synthetic derivative products.

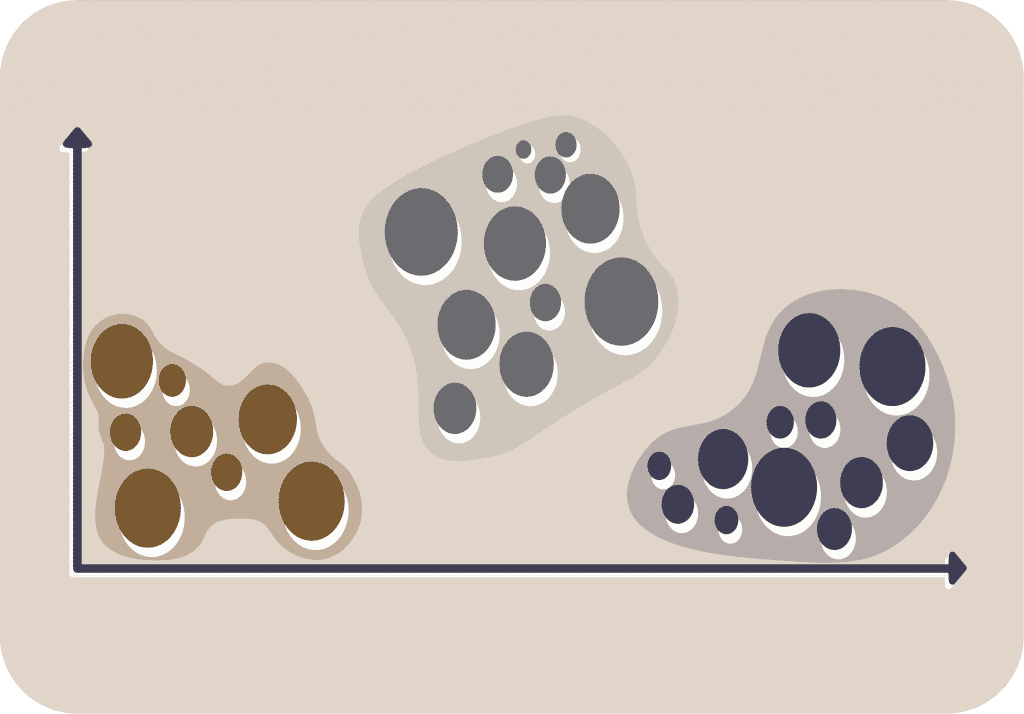

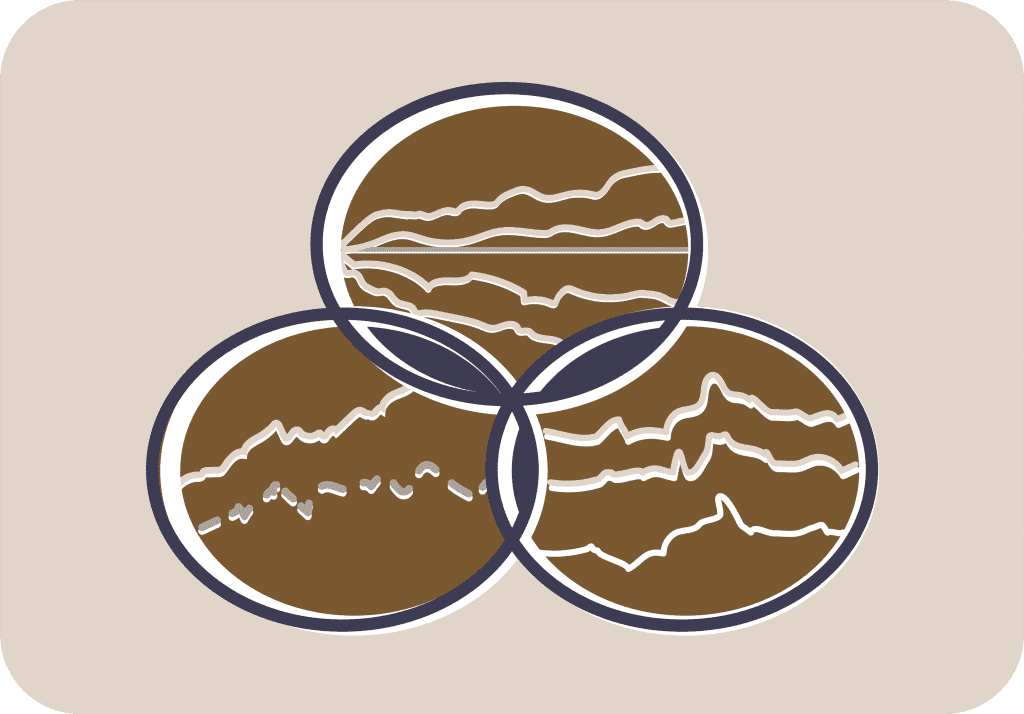

Introduction to Clustering Methods In Portfolio Management

We choose the most popular clustering methods such as Partitioning Around Medoids (PAM), Hierarchical Clustering, and Gaussian Mixture Model to introduce them and show examples of their usage in portfolio management. Complete methodology for all three methods is available in the following article and its 2nd and 3rd continuation.

Three Simple Tactical FX Hedging Strategies

Systematic tactical FX hedging uses currency factor strategies such as currency carry, currency momentum, and currency value to protect a current or predicted position from an unwanted move in an exchange rate. Therefore, tactical FX hedging strategies serve as a good starting point for investors who need to decide when to hedge and when not to hedge their FX risk.

An Introduction to Value at Risk Methodologies

Value at Risk (VaR) is the maximum loss with a given probability, in an established period, with an assumed probability distribution, and under standard market conditions. It helps to understand what level of risk we can expect during a crisis to better prepare for it.

How to Combine Different Momentum Strategies

This blog will analyze and combine different US stock momentum strategies using five pre-coded asset and strategy allocation methods from Quantpedia Pro’s toolbox. As follows, we proved that it’s possible to combine strategies more sophisticatedly and improve risk-adjusted returns even in real-life implementations.

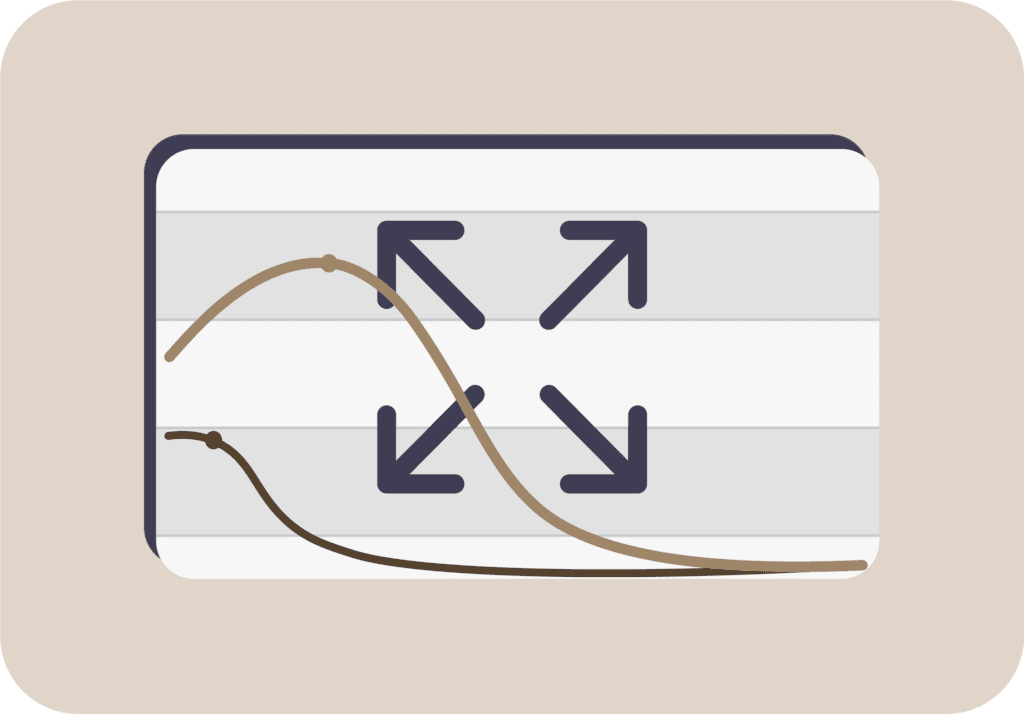

Introduction to Dollar-Cost Averaging Strategies

Dollar-Cost Averaging report helps our clients test and analyze different approaches to investment and divestment of model portfolio. Investors can choose between making regular, piecewise investments, regardless of market conditions (Dollar-Cost Averaging), and the riskier way – investing all at once (Lump-Sum Investment).

Beware of Excessive Leverage – Introduction to Kelly and Optimal F

Kelly and Optimal F is a position sizing method that helps investors and traders choose the correct size of an investment. As a result, they do not overbet when assessing the maximal leverage that’s rational to employ in the model portfolio.

Introduction and Examples of Monte Carlo Strategy Simulation

The Monte Carlo method is a category of algorithm that relies on repeated random sampling to obtain different scenario results. Monte Carlo simulations are used to predict the probability of different outcomes when it would be difficult to use other approaches such as optimization.

ETFs: What’s Better? Full Replication vs. Representative Sampling?

ETFs employ two fundamentally different methods to replicate their underlying benchmark index. Physical or full replication involves holding all constituent securities or a representative sample of the benchmark index. These methods should interest ETF investors, who are often encouraged to focus on factors such as expenses and fees when selecting investments.

Multi Strategy Management for Your Portfolio

How to manage multi-strategy portfolios? Our Quantpedia Pro tool focuses on simple multi-strategy overlays based on trend-following and mean-reversion. Moreover, we apply these overlays to the original unadjusted and volatility-adjusted strategies. Therefore, this blog can help to answer when to overweight and underweight strategies in your portfolio.

Automated Trading Edge Analysis

Trading Edge Analysis examined various statistical, empirical, and other trading properties of underlying assets. As a result, we know which trading edges work and which don’t seem to when applied to our chosen asset and then derive potential trading strategies out of the promising ones.

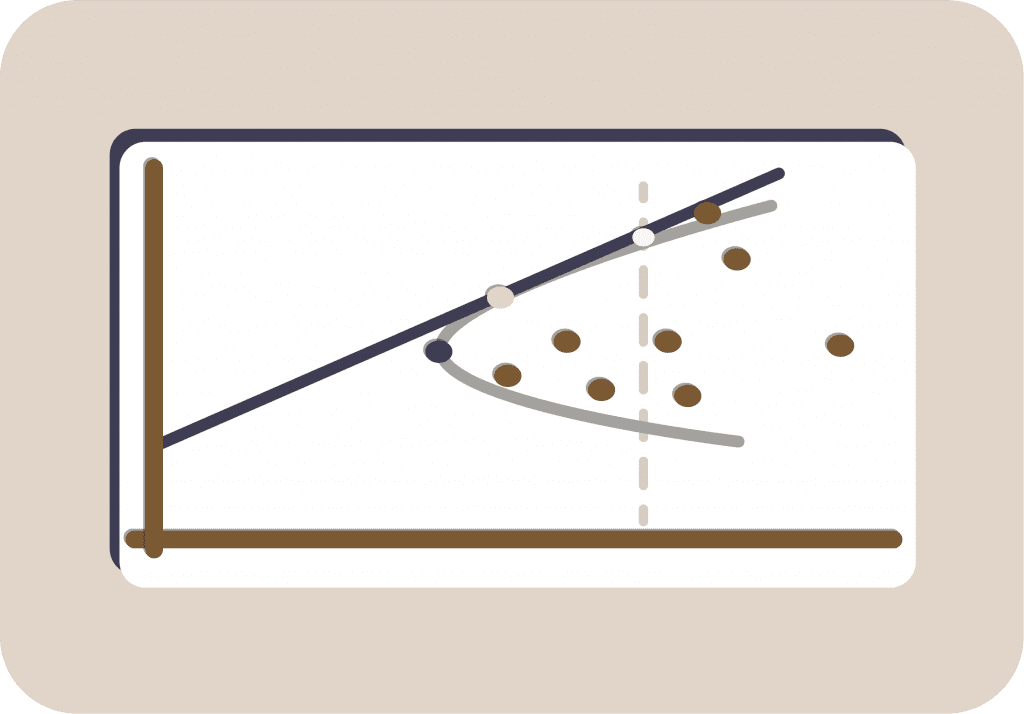

How to Replicate Any Portfolio

This article explains how we created such a long history and allows you to analyze your strategy’s risk under 100 years of real historical scenarios. Subsequently, we introduced the multi-factor regression model, which picks the optimal mimicking factors, and Akaike’s Information Criterion (AIC), which penalizes unnecessary factors.

A Simple Approach to Market-Timing Strategy Replication

This approach allows us to perform the multi-factor analysis without implementing recognition algorithms for market-timing strategy. Moreover, our method works very well on the subset of market-timing strategies built on calendar-based or period-based rules. Therefore, the results carry a significant value for the types of market-timing strategies with irregular in-market patterns.

How to Paper Trade Quantpedia Backtests

Quantpedia offers tips to translate Quantconnect backtests into actual paper trading. QuantConnect Paper Trading is a simulation environment that lets you test your trading algorithm using real-time data feeds with fictional capital for various assets without risking real money.

Quantum Computing as the Means to Algorithmic Trading

Quantum computing is a new and exciting technology that could revolutionize computing as we know it. It has the potential to make significant contributions in fields such as medicine, security, and finance. At Quantpedia, we are particularly interested in its potential to optimize portfolios. In this article, we will explore the concept of quantum computers, their current state, their potential use in finance, and more.

100 Years of Historical Market Cycles

In Quantpedia, we are starting a new series of articles to provide exact answers to questions about how different assets perform during rising rates and inflation and how the business cycle impacts this. This article series can also serve as an introduction to the methodology used in the Quantpedia Pro report.

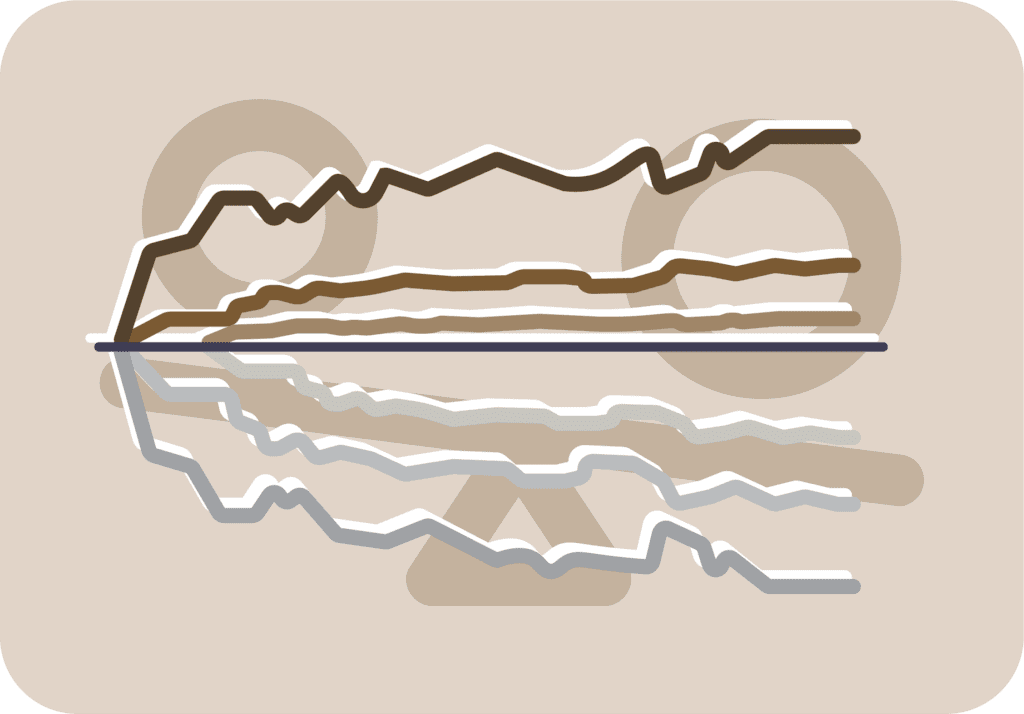

A Balanced Portfolio and Trend-Following During Different Market States

In this article, we will explore the performance of a balanced portfolio and trend-following strategies in different market cycles. This article builds on a previous one where we identified bear and bull markets, high and low inflation, and falling and rising interest rates over the past century. In addition, we used an AOR ETF as a benchmark for balanced funds.

Factor’s Performance During Various Market Cycles

This article analyzes our Balanced Portfolio ETF (AOR) performance over the past century using our Multi-Factor Regression Model. In addition, we compare AOR’s performance to other factors using risk/return tables sorted by Sharpe ratio.

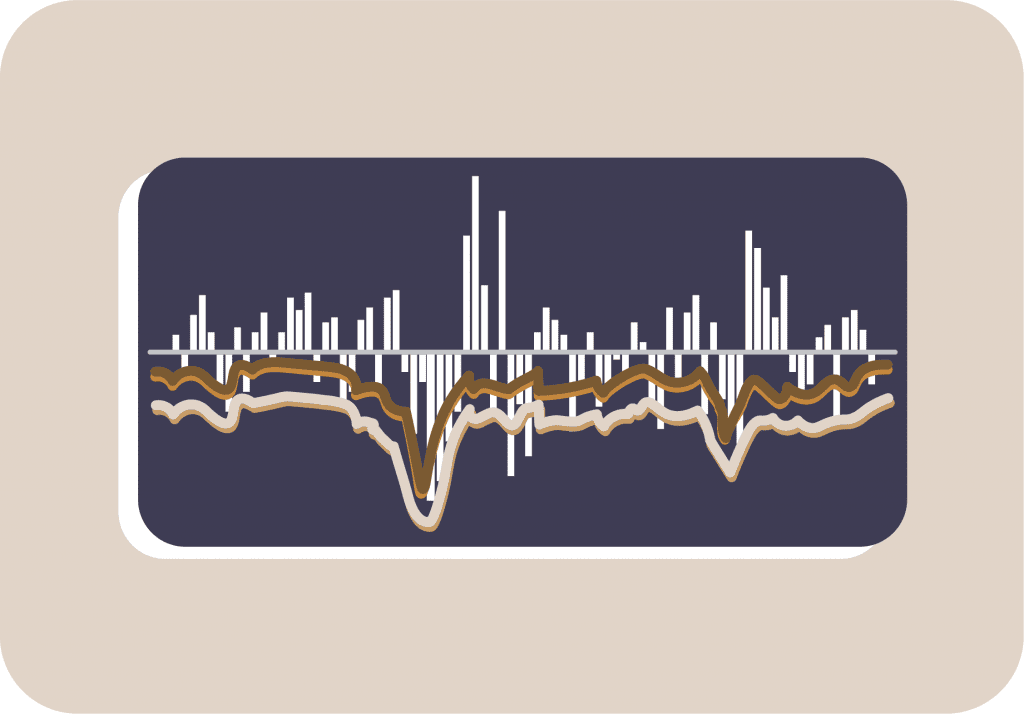

Defining Market Cycles Out of Sample

Previous articles explored how different market cycles can impact portfolio and market factor performance. So far, these market states have been identified in-sample. The following article will define the same market states out-of-sample and explain our methodology. Understanding both in-sample and out-of-sample market cycle analysis can help make investment decisions.

An Analysis of Rebalancing Performance Dispersion

This article highlights the significance of rebalancing in long-term investing and how it can affect a portfolio’s overall performance and risk. In addition, the article provides an analysis of the impact of rebalancing on portfolio returns and serves as an introduction to the methodology for a Quantpedia Pro report that enables users to assess the effect of the rebalancing period on any combination of various assets.

In-Sample vs. Out-Of-Sample Analysis of Trading Strategies

Explore the impact of the long-standing “replication crisis” in science on investors and traders. Gain insights into the fate of academic-developed trading strategies and investment approaches once made public. Discover the out-of-sample decay of trading strategies as we revisit our previous blog post, supported by hard data from our regularly updated database of replicated quant strategies.

Evaluating Long-Term Performance of Equities, Bonds, and Commodities Relative to Strength of the US Dollar

Discover the significance of the US dollar as the world’s primary reserve currency and its role in global trade and commodity pricing. Explore the impact of the dollar’s strength or weakness on various asset classes, including US equities, treasury bonds, and commodities. Gain valuable insights from a cross-asset analysis using historical exchange rate data spanning almost a century.

Technical Analysis Report Methodology + Double Bottom Country Trading Strategy

Uncover the captivating realm of market analysis where price dynamics hold the key to asset secrets, despite the market’s intricate nature. Delve into the dichotomy between fundamental insights and market psychology, where even post-surge news finds its roots. Explore the interplay of fundamentals and psychology driving markets, revealing the indispensable role of Technical Analysis beyond mere speculation.

Avoid Equity Bear Markets with a Market Timing Strategy – Revisiting Our Research

The article revisits the TrendYCMacro market timing strategy, aiming to avoid bear markets. Originally using U.S. S&P Composite dividends, a forward-looking bias was identified due to quarterly data interpolation. To eliminate this issue, the strategy now employs Housing Starts Growth from FRED, ensuring a more accurate and unbiased approach.

An Introduction to Machine Learning Research Related to Quantitative Trading

This article navigates the recent surge in interest surrounding machine learning and AI, particularly in the wake of the widely embraced ChatGPT. Delving into the historical foundations, it unravels the roots of machine learning, tracing its evolution over the last decade and beyond.

Hello ChatGPT, Can You Backtest Strategy for Me?

In this article, we revisit a topic explored over six months ago in the rapidly evolving field of Artificial Intelligence. Focusing on the advancements of the OpenAI chatbot, ChatGPT, the text explores its potential improvements and investigates whether it can serve as a backtesting engine. The article also revisits risk parity asset allocation, pushing the boundaries of current AI development.

Is It Good to Be Bad? – The Quest for Understanding Sin vs. ESG Investing

In the following article, the spotlight is on ESG investing, a growing trend in portfolio management emphasizing a company’s Environmental, Social, and Governance (ESG) scores. As ESG investing gains mainstream popularity, the article questions whether it provides an “alternative alpha”, showcasing potential outperformance against traditional benchmarks.

Military Expenditures and Performance of the Stock Markets

In this article, we explore the age-old military strategy encapsulated in the Roman proverb “Si vis pacem, para bellum” (“If you want peace, prepare for war”). Considering the modern context of global interconnectedness, the article questions whether the substantial investments made by states in their defense translate into financial rewards, particularly in terms of outperforming stock markets compared to their peers.